LIC Jeevan Amar Plan

Table of Contents

LIC Jeevan Amar Plan No. 855 is a non-participating, non-linked, pure protection plan that offers the flexibility to choose between two death benefit options, such as Lump Sum Insured and Increasing Sum Insured. LIC has launched this new term insurance plan with many new and attractive features keeping in mind the changing times and the needs of the customer. For example, under this term insurance policy, different premium rates have been maintained for non-smokers and women. You can take this plan to get coverage up to the age of 80. Not only this, but the family with the death benefit has also been given the option of receiving installments or a lump sum. Most importantly, you cannot claim the sum assured at maturity since it is a non-linked term insurance plan. This policy is currently available offline. Here is everything you want to know.

| Plan No. | 855 |

| Launch Dated | 5 Aug 2019 |

Why we should buy this Jeevan Amar Plan?

We are always concerned about what will happen to our family when the main breadwinner is not there, how they will bear the entire financial burden, etc. and that is why we would like to have a solid insurance plan that can take care of our family in our absence. So here comes the importance of the Term Insurance Plan. As a term insurance plan, you get great coverage at a very affordable premium, and therefore the best form of protection.

Advantage of High Sum Assured Rebate.

Advantage of High Sum Assured Rebate.- Available at special rates for women.

- Option to add riders to enhance coverage.

- Life insurance available till the age of 80

- Two premium rate categories, namely non-smoking rates and smoking rates.

- The plan offers the flexibility to choose between two benefit options, such as Sum Insured and Increasing Sum Insured.

- Offers flexibility in premium payment options such as one-time premium, regular premium, and limited premium payment.

What are the Death Benefits available in this Jeevan Amar Plan?

LIC’s Jeevan Amar Plan presents multiple features to better serve customers. All features are designed in a way that they can offer various benefits. In the event of sudden death during the term of the policy, your family/nominee will be entitled to receive the full sum insured.

What is the Surrender Value available in this Jeevan Amar Plan?

There will be no surrender value under the regular premium. However, you will get it in the case of a Single Payment and Limited Payment Option according to regulations.

What are the Riders available in this Jeevan Amar Plan?

The plan also includes additional riders that will greatly help improve basic coverage. You can choose to take an accidental death benefit rider by paying an additional amount. In the event of death due to an accident, you will get the benefit of the rider in addition to the sum assured in the plan.

What are the Premium Payments available in this Jeevan Amar Plan?

This plan is designed to offer multiple premium payment options. You can choose the regular premium, limited premium, or one-time premium payment options.

- Regular Premium -In this option, you must pay every year, during the term of the policy. So if you have chosen a term up to 80 years, you will have to make payments until then.

- Limited Premiums -This option has become popular with the start of longer policy terms. Best for those who want to stop paying their premiums during or immediately after their working years and continue to enjoy coverage for the entire period. You can select a premium payment term:

- Policy term minus 5 years

- Policy term minus 10 years

- Single-Premium -Pay just once and enjoy coverage for the entire term of the policy without worrying about future payments. Best for those who don’t have a regular predictable income stream and now have cash on hand.

What is the Grace Period available in this Jeevan Amar Plan?

It is an important feature that you should know about. There is a grace period of around 30 days for the payment of annual or semi-annual premiums from the date of the first unpaid premium.

What are the Taxes benefits available in this Jeevan Amar Plan?

Statutory taxes on said insurance plans by the Government of India or any other constitutional tax authority of India will be applied in accordance with the laws.

What is the Free Look Period available in this Jeevan Amar Plan?

If you are not satisfied with the insurer or the plan, you can cancel it within the free trial period which is less than 15 days from the purchase date.

What are the Death Benefits in Installments available in this Jeevan Amar Plan?

Instead of a lump sum, this plan offers the option of receiving the death benefit in installments for a chosen period of 5, 10, or 15 years.

Is there any Rebate / Loading available in this Jeevan Amar Plan?

The plan offers a High Sum Assured Rebate that applies to regular, limited, and Single Premium payment options.

What is Revival?

An expired policy can be easily reactivated during the entire life of the insured. However, it must be within a period of 5 consecutive years from the date of the first unpaid premium or according to the regulations allowed for products.

What are the Maturity Benefits available in this Jeevan Amar Plan?

In the case of survival of the insured life until the end of the policy term, no benefit is paid.

Is there any Policy Loan available in this Jeevan Amar Plan?

There will be no loan facility with this insurance policy.

What are the Exclusions?

- By the way, if the insured (whether sane or insane) commits suicide within 12 months from the date of commencement of risk. As a result, the corporation will not accept any claim on the policy. Only 80% of the total premium paid would be returned provided the policy is in force.

- Similarly, if the insured (whether sane or insane) commits suicide within 12 months from the date of revival then an amount that is higher of 80% of the total premiums paid till the date of death or the surrender value available as on the date of death shall be payable. The corporation will not entertain any other claim on this.

This clause will not be applicable for a lapsed policy without acquiring paid-up value and nothing will be paid under said policy.

Read to know more about this:

- एलआईसी का जीवन अमर टर्म प्लान 855 लॉन्च, जानिए बड़ी बातें।

- लेना चाहते हैं LIC का Jeevan Amar Plan? अपनाएं ये सरल हैं तरीके।

- LIC लाया नया टर्म इंश्योरेंस प्लान Jeevan Amar, 80 साल तक मिलेगा कवरेज, जानें क्या है इसमें स्पेशल और अन्य डिटेल्स।

Also, read this – Why is LIC’s New Jeevan Anand Plan the Best Choice for Young Couple?

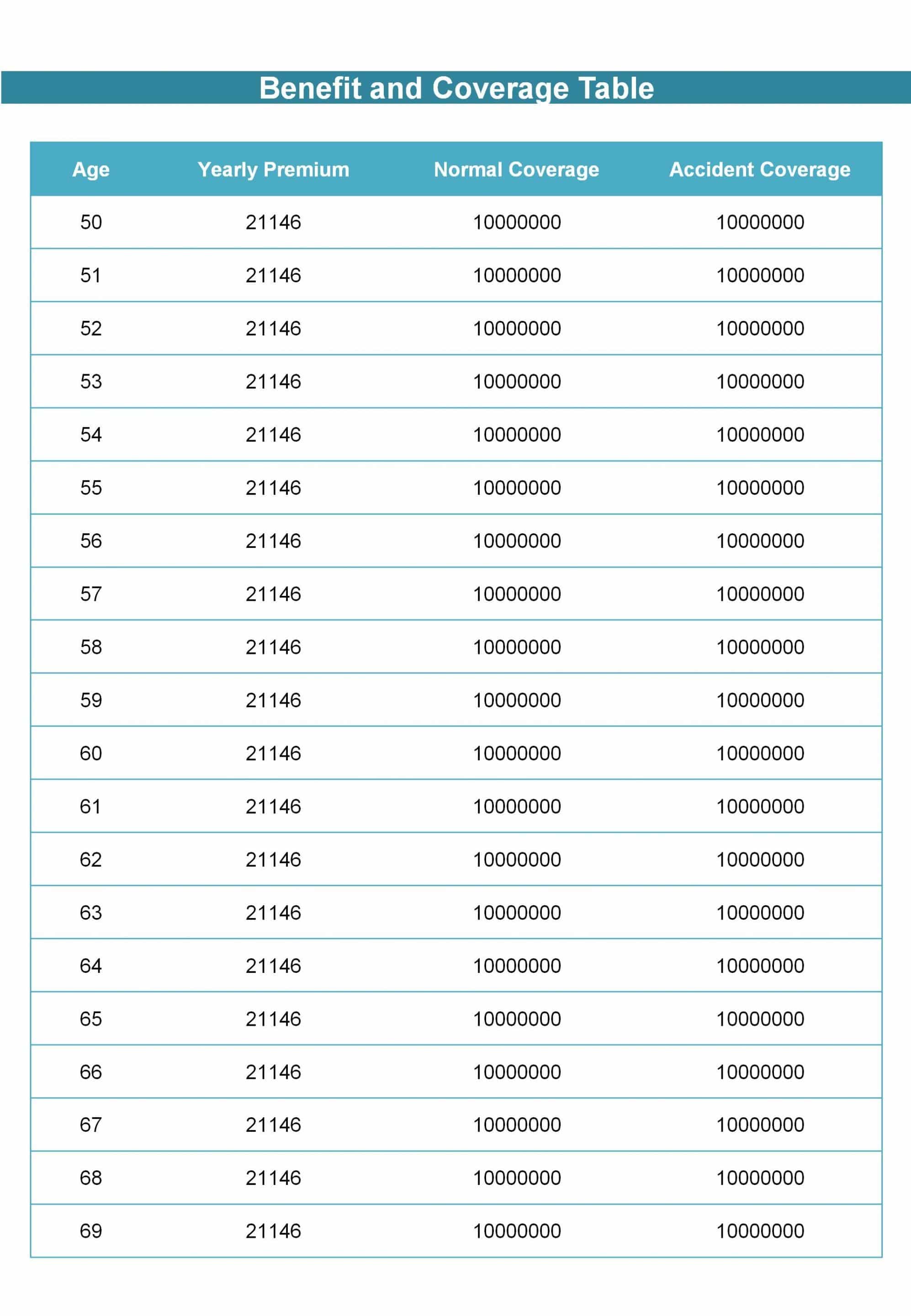

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.

FAQs on LIC’s Jeevan Amar Plan

FAQs on LIC’s Jeevan Amar Plan

Is it possible to date back the policy?

Are riders available under the plan?

LIC's Market Share 75.9%, Growth in NB Premium 39.46%, Growth in 1st Year Premium 25.17%, Growth in Total Premium 12.42%, Growth in Gross Total Income 9.83%, Growth in Total Asset Value 2.71%, Growth in Digital Transaction 36% in FY 2019-20.

It also has a Claim Settlement ratio of 98.33%.

It is the most trusted Life Insurance Company in the country. It has a Sovereign Guarantee which other Companies don't have.

![]() WHY GO SOMEWHERE ELSE?

WHY GO SOMEWHERE ELSE?

0 Comments