LIC New Children’s Money Back Plan

Table of Contents

LIC New Children’s Money Back Plan is an individual, participating, non-linked, life insurance savings plan. Especially, parents and grandparents take this New Children’s Money Back Plan for their growing children due to two characteristics such as security provided until the age of 25 and then offering maturity with a lump sum to meet important objectives. In this New Children’s Money Back Plan, children’s lives are insured since life insurance coverage can be used for education and marriage. New Children’s Money Back Plan provides three cash backs at 18, 20, and 25 years of age and maturity of the child policyholder at 25 years of age of the child policyholder. The Premium Waiver Benefit (PWB) clause makes this New Children’s Money Back Plan more attractive. Here is everything you want to know.

|

Plan No. |

932 |

|

Launch Dated |

1 Feb 2020 |

Why should we buy this New Children’s Money Back Plan?

Nowadays when the costs of products and services are increasing day by day, children’s future must not suffer due to financial problems. Many children cannot fulfill their passions or dreams and some even cannot get higher studies due to financial problems.

Nowadays when the costs of products and services are increasing day by day, children’s future must not suffer due to financial problems. Many children cannot fulfill their passions or dreams and some even cannot get higher studies due to financial problems.

To eliminate these problems and to give financial assurance to them, LIC has come up with a lucrative affordable insurance policy i.e. LIC’s New Children’s Money Back Plan.

Features Highlight:

- This is a participating, non-linked, money back plan, therefore, earns simple reversionary bonuses.

- It is designed to cater to the needs of a child at the age when he/she needs it the most such as higher studies, marriage, etc.

- The minimum annual premium is as low as Rs.24000.

- The policyholder can take a loan from this plan.

- Various optional riders are there to choose which can create some additional coverage with the maturity value.

- The policy can be availed of during the age of 0-12 of the child.

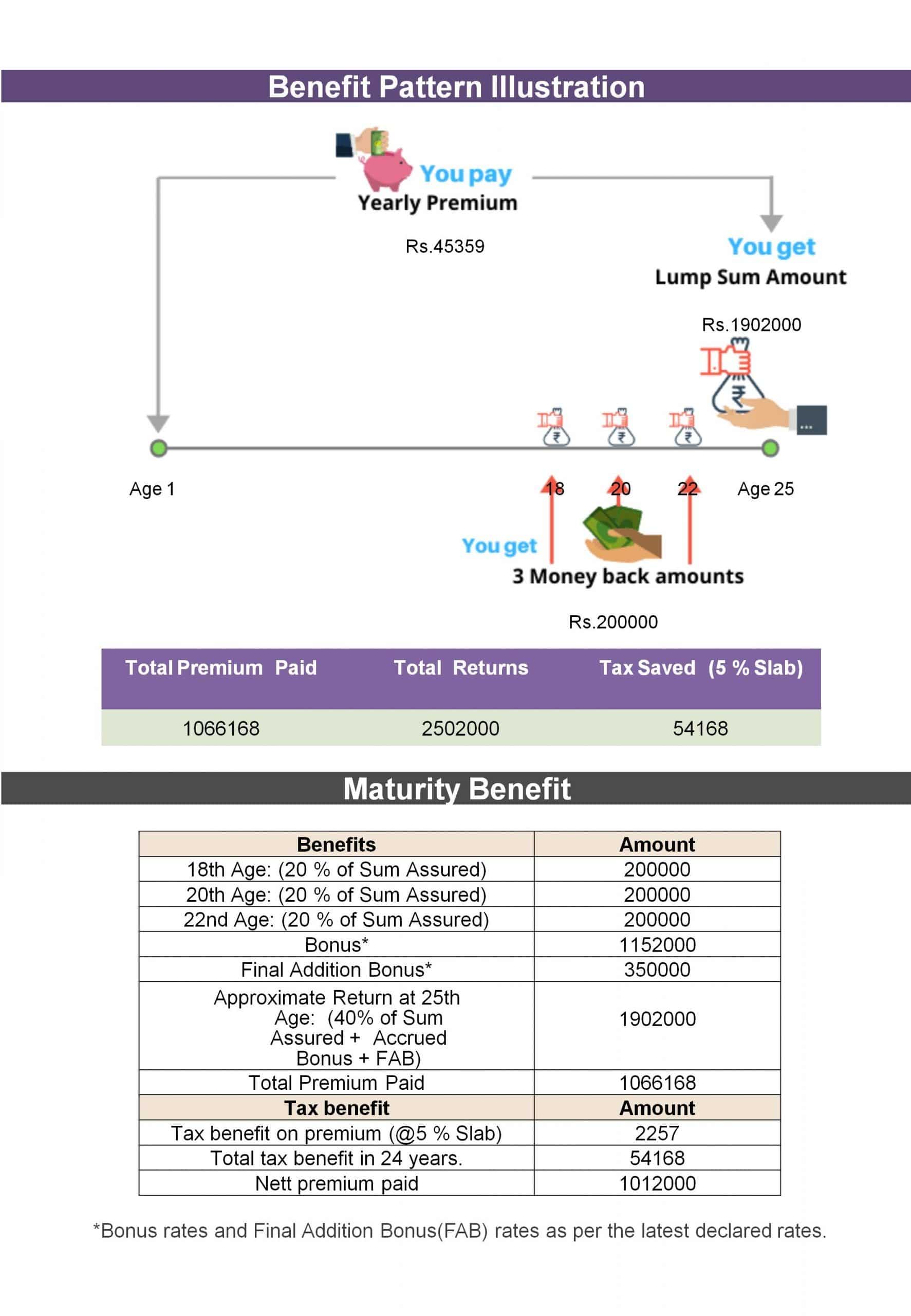

- The insured gets 20% of the Basic Sum Assured at each anniversary of 18,20 and 22 age.

Does this plan provide Risk Cover?

It provides the risk coverage on the life of the child during the policy term and the number of survival benefits when surviving until the end of the specified term.

Who can buy this Child Money Back Plan?

It can be purchased by either parent or grandparent for a child from 0 to 12 years old.

What are the benefits of this New Children’s Money Back Plan?

-

Maturity Benefit

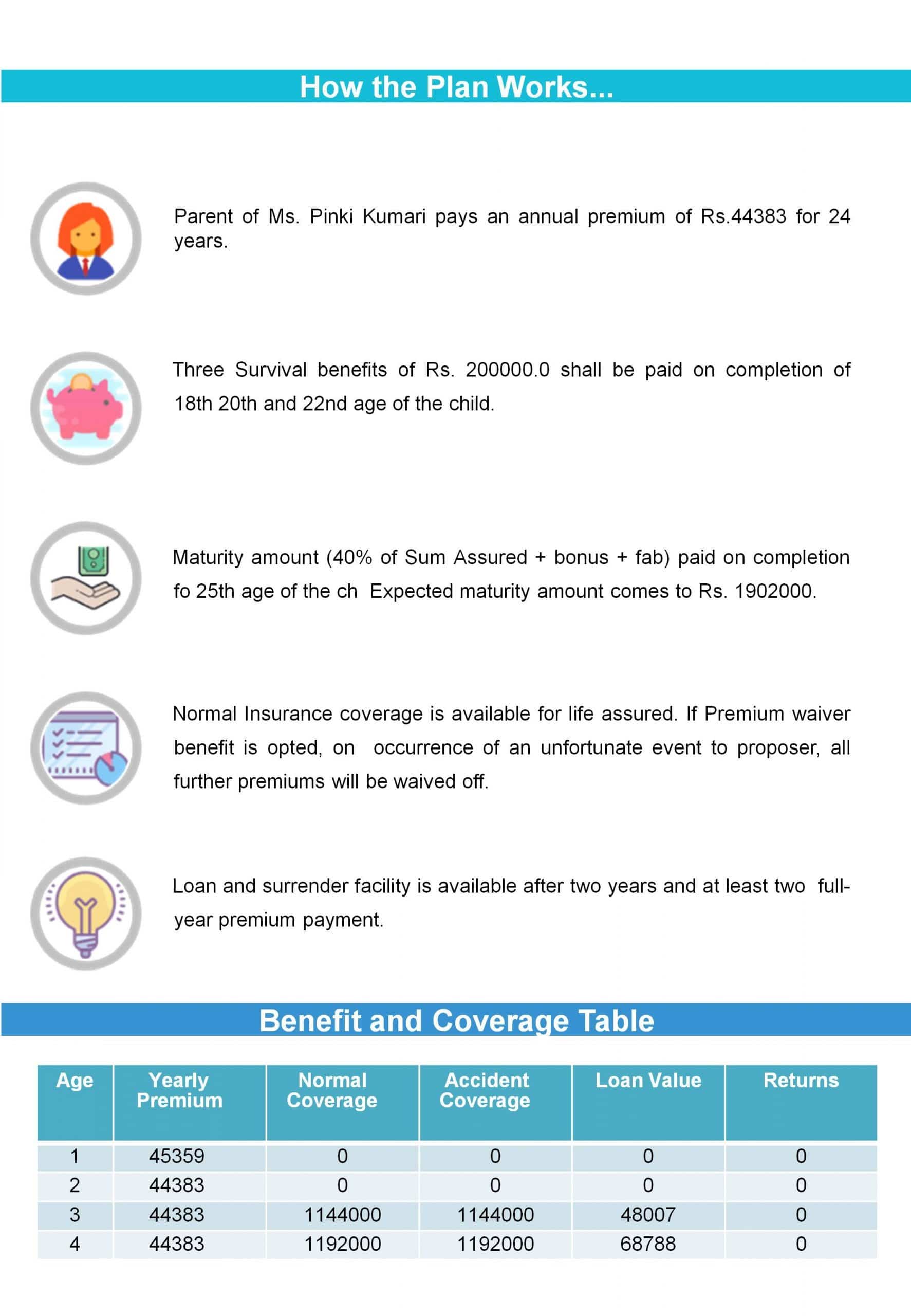

When the policyholder survives and attains 25 years of age, the policy’s period comes to an end. The insured gets 40% of the Basic Sum assured with vested Simple Reversionary Bonuses and Final Additional bonus (if any). If any rider is opted for, it will be paid likewise.

The policy participates in profits, hence earns Simple Reversionary Bonuses based on the experience of the corporation. The Final Additional Bonus will not be entertained by a paid-up policy.

-

Survival Benefit

In case of the survival of the insured person, he/she receives 60% of the total sum assured by splitting it into three equal amounts before the maturity date.

- Attaining 18 years of age, the insured gets 20% of the Basic Sum Assured.

- Attaining 20 years of age, the insured gets 20% of the Basic Sum Assured.

- Attaining 22 years of age, the insured gets 20% of the Basic Sum Assured.

There is also an option to defer the survival benefit. The policyholder may take the benefit at any time on or after its due date but during the currency of the policy.

-

Death Benefit

Unfortunately, if the death of the life assured happens during the term of the policy, benefits will be provided to the nominee are as follows:-

- Death before the date of commencement of risk: Total premiums paid till death excluding taxes, is to be paid.

- Death after the date of commencement of risk: Total amount i.e. the sum of Sum Assured on Death with Simple Reversionary Bonus and Additional bonus (if any) is to be paid.

Sum Assured on Death is higher of:

- Absolute Basic Sum Assured

- 10 times of the annual premium

- 105% of the total premium paid till the death of the policyholder.

What are the Eligibility Conditions and Other Restrictions?

|

Minimum Basic Sum Assured |

Rs. 100,000 |

|

Maximum Basic Sum Assured |

In multiples of Rs. 10,000 |

|

Minimum Age at entry for Life Assured |

0 years (last birthday) |

|

Maximum Age at entry for Life Assured |

12 years (last birthday) |

|

Minimum/ Maximum Maturity Age for |

25 years (last birthday) |

|

Policy Term/Premium Paying Term |

[25 – Age at entry] years |

What would be the date of commencement of risk if I buy this plan?

In the event that the entry age of the Life Insured is less than 8 years (last birthday), the risk under this plan will begin either one day before the end of 2 years from the date of commencement of the policy or one day before the policy anniversary coincides. with or immediately after reaching 8 years of age, whichever occurs first. For those over 8 years old, the risk will begin immediately from the date of issue of the policy.

What would be the date of vesting under the Plan?

The policy will be automatically awarded to the Life Insured on the policy anniversary coinciding with or immediately after the end of the age of 18 and, in such case, it will be considered to be a contract between the Corporation and the Life Insured.

What are the options available for this New Children’s Money Back Plan?

Option to defer the Survival Benefit(s):

The policyholder can avail of this option to take the Survival Benefit(s) at any time on or after its due date. The corporation will pay increased Survival Benefit (s) equal to:

Survival Benefits % * Sum Assured * Applicable Factor

The policyholder will be required to disclose this option in writing six months prior to the maturity date of the Survival Benefit to the policy branch of service.

Rider Benefits:

LIC’s Premium Waiver Benefit Rider can be opted for on the life of Proposer of the policy subject to the life assured under this policy is a minor while opting for the rider, LIC’s Premium Waiver Benefit Rider can be opted for on the life of Proposer of the policy.

The premium of this rider will not exceed the base premium. The term of this rider will be calculated from the age while opting for this rider up to 25 years of age of the policyholder.

Death Benefit can be taken by installments over a period of 5 or 10 or 15 years, provided the policy is in force as well as a paid-up policy. It can be of yearly, half-yearly, quarterly or monthly installment (through NACH or Salary Deduction only).

|

Mode of Installment Payment |

Minimum Installment Amount |

|

Monthly |

Rs. 5,000/- |

|

Quarterly |

Rs. 15,000/- |

|

Half-Yearly |

Rs. 25,000/- |

|

Yearly |

Rs. 50,000/- |

The interest rates will be fixed by the corporation.

Maturity Benefit in installment:

There is a Settlement Option under this policy which allows the policyholder to take the Maturity Benefit in installments. The installments will be paid yearly or half-yearly or quarterly or monthly basis provided the policy is in force and must be a paid-up policy.

|

Mode of Installment Payment |

Minimum Installment Amount |

|

Monthly |

Rs. 5,000/- |

|

Quarterly |

Rs. 15,000/- |

|

Half-Yearly |

Rs. 25,000/- |

|

Yearly |

Rs. 50,000/- |

The interest rates will be fixed by the corporation.

If the death of the life-assured, who has exercised Settlement Option, occurs after the maturity date, in such case the nominee will get the outstanding installments.

What is the various Payment of Premiums mode is available?

You can pay premiums regularly at yearly, half-yearly, quarterly or monthly mode (through NACH or through salary deduction (SSS) only).

What is the Grace Period and How many days are provided?

Here when the policyholder cannot pay the premium on time, a grace period of 30 days for every yearly, half-yearly and quarterly premium and a 15 days grace period for every monthly premium is there within which the policyholder has to pay the premium. If he/she cannot pay within the grace period, then the policy will lapse.

How can I avail Rebates under the policy?

Policyholders can avail of various rebates in the premium payment under this policy.

Mode Rebate:

|

Yearly Mode |

2% of Tabular Premium |

|

Half-yearly mode |

1% of Tabular premium |

|

Quarterly, Monthly (NACH or SSS) mode |

NIL |

High Sum Assured Rebate (on Premium):

|

1,00,000 to 1,90,000 |

Nil |

|

2,00,000 to 4,90,000 |

2 per thousand S.A. |

|

5,00,000 and above |

3 per thousand S.A. |

What is Revival and How can I revive my policy if lapsed?

In case the policyholder cannot pay the premium before the expiry of the grace period, the policy lapses. Here comes the Revival Period of 5 consecutive years from the date of the first unpaid premium within which the lapsed policy can be revived. The revival will come into effect after all the arrears are paid with an interest rate as fixed by the corporation.

What is Paid-up Policy?

If premiums have been paid for less than two years and any subsequent premiums are not duly paid, all the benefits will be ceased after the grace period, wherefore nothing will be payable to the policyholder.

After at least two full years of premiums have been paid, if any subsequent premiums are not duly paid, the policy will not be fully ceased. Hence, the policy will continue as a paid-up policy until the end of the policy term.

Here the sum assured on death under the paid-up policy will be reduced to a sum namely “Death Paid-Up Sum Assured”. In addition to it, vested Simple Reversionary Bonus will also be payable. Survival benefit is unavailable in case of a paid-up policy.

Can I surrender my Child Money Back policy?

The policy can be surrendered any time only after two full year’s premiums have been paid. The surrender value will be equal to the higher of the Guaranteed Surrender Value or Special Surrender Value.

The guaranteed surrender value depends on the policy term and the policy year in which the policy is surrendered. It is equal to the total premiums paid (excluding any extra premium, taxes, and premiums for a rider, if opted for), multiplied by the guaranteed surrender value factor applicable to total premiums paid and then reduced to any survival benefits already paid (including survival benefits already deferred) under the policy.

Furthermore, the surrender value of any Simple Reversionary Bonuses, if any, is also payable.

How can I avail Policy Loans under this plan?

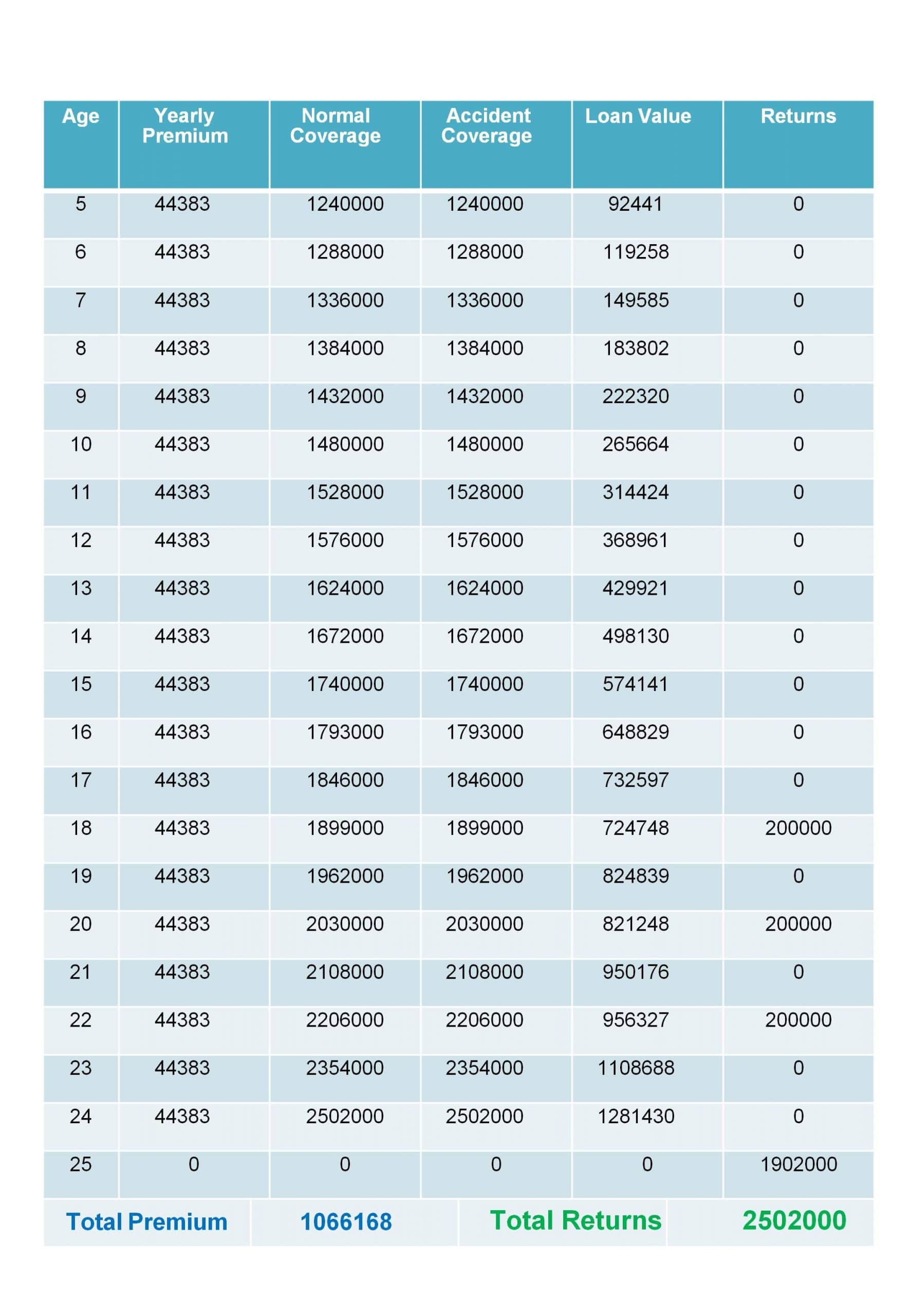

A loan can be availed under the policy, provided at least two full years of premiums have been paid and subject to the terms and conditions as the corporation may specify time to time.

The maximum loan allowed under the policy, as a percentage of surrender value, will be as under:

- For in-force policy – up to 90%

- For paid-up policy – up to 80%

The interest rates to be charged for the policy loan and as applicable for the entire term of the loan will be determined at periodic intervals. The applicable interest rates will be as declared by the corporation based on the method approved by IRDAI.

Any loan outstanding along with interest will be recovered from the claim proceeds at the time of exit.

What are the implications of Taxes?

Statutory Taxes, if any, imposed on such insurance plans by the Government of India or any other constitutional Tax Authority of India will be as per the prevailing rates will be payable by the policyholder on the premiums for Base Plan and Rider, if any, including extra premiums if any which will be collected separately over and above in addition to the premiums payable by the policyholder. The amount of tax paid will not be considered for the calculation of benefits payable under the plan.

How many days are provided in the Free Look Period?

If the Policy Term and Conditions cannot satisfy the policyholder, he/she may return it to the Corporation within 15 days from the date of receipt of the policy bond stating the reasons for the objection. The corporation will then cancel the policy and return the amount of the deposited premium after deducting the proportional risk premium (for the basic plan rider, if applicable) for the coverage period, the expenses incurred in the special reports of medical examinations, if applicable, and charges for stamp duty.

What is Suicide Exclusion?

The policy will be declared as void, if the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk. The nominee will be paid only 80% of the total premiums paid provided the policy is in force. This clause will not be applicable in case of age at entry of the Life Assured is below 8 years.

In case the Life Assured (whether sane or insane) commits suicide within 12 months from the date of revival, an amount that is higher of

- 80% of the total premiums paid till the date of death or

- The surrender value available on the date of death will be payable.

The Corporation will not entertain any other claim under the policy.

Read to know more about this:

LIC न्यू चिल्ड्रन मनी बैक प्लान में प्रतिदिन 148 रुपये का निवेश, आपको मिलेंगे 19 लाख, और भी कई फायदें।

Also, read this – Why should We Buy LIC’s Jeevan Lakshya Plan?

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.

0 Comments