Why should We Buy LIC’s Jeevan Labh Plan?

LIC’s Jeevan Labh Plan

LIC Jeevan Labh Plan No. 936 – is a traditional, non-linked (not dependent on equity and money/stock market funds), limited premium payment with profit plan. The Jeevan Labh Plan is one of the effective life insurance plans offered by the Life Insurance Corporation of India. It provides savings and protection to policyholders. It means that you will stay protected and be able to save your money efficiently. It offers death and maturity benefits along with profit-sharing bonuses. If the insurance company makes a profit in a financial year, those profits are distributed to the insured as a bonus. Participating endowment plans become eligible for bonus declarations made by the insurance company. People in the age group of 8-59 years can take this Jeevan Labh Plan. In this Jeevan Labh Plan, you do not have to pay the premiums during the entire period of the policy, and at the end of the policy term; you will get the benefits of maturity. In the event of the death of the policyholder at any time during the term of the policy, the nominee will receive the Death Benefit in the form of Sum Insured and Bonuses. The Jeevan Labh Plan also addresses liquidity needs through its loan facility. Here is everything you want to know.

| Plan No. | 936 |

| Launch Dated | 1 Feb 2020 |

Why should we buy this Jeevan Labh Plan?

LIC’s Jeevan Labh is a limited premium paying, Non-Linked, Participating, Individual, Life Assurance saving plan which offers an attractive combination of protection and savings features. This combination provides financial support for the family of the deceased policyholder in case of unfortunate death of the policyholder any time before maturity and a lump sum amount at the time of maturity for the surviving policyholder. This plan also takes care of liquidity needs through its loan facility.

What does this Jeevan Labh Plan offer as Benefits?

Death benefit:

The death benefit payable in case of death of the Life Assured during the policy term, provided the policy is in force shall be “Sum Assured on Death” along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any. Where “Sum Assured on Death” is defined as the higher of Basic Sum Assured or 7 times of annualized premium.

This death benefit shall not be less than 105% of the total premiums paid up to the date of death. Premiums referred above exclude taxes, extra premiums, and rider premium(s) if any.

Maturity Benefit:

On Life Assured surviving to the end of the policy term provided the policy is in force, “Sum Assured on Maturity” along with vested Simple Reversionary bonuses and Final Additional Bonus, if any, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Participation in Profits:

The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation, provided the policy is in- force.

Final (Additional) Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity Final Additional Bonus shall not be payable under paid-up policies.

What are the Eligibility Conditions and Other Restrictions?

- Minimum Basic Sum Assured: Rs. 2,00,000

- Maximum Basic Sum Assured: No Limit

(The Basic Sum Assured shall be in multiples of Rs. 10,000/-)

- Policy Term/Premium Paying Term : (16/10), (21/15) & (25/16) years

- Minimum Age at entry : [8] years (completed)

- Maximum Age at entry : [59] years (nearest birthday) for Policy Term 16 years

[54] years (nearest birthday) for Policy Term 21 years &

[50] years (nearest birthday) for Policy Term 25 years

- Maximum Maturity Age : [75] years (nearest birthday)

What is the date of commencement of risk under the Jeevan Labh Plan?

The risk will commence immediately on acceptance of the risk.

What is the date of vesting under the Jeevan Labh Plan?

The policy shall automatically vest in the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

What are Options available in this Jeevan Labh Plan?

Rider Benefits :

The following five optional riders are available under this plan by payment of additional premium. However, the policyholder can opt between either of the LIC’s Accidental Death and Disability Benefit Rider or LIC’s Accident Benefit Rider. Therefore, a maximum of four riders can be availed under a policy.

LIC’s Accidental Death and Disability Benefit Rider

This rider can be opted for at any time within the premium paying term of the Base plan provided the outstanding premium paying term of the base plan is at least 5 years. The benefit cover under this rider shall be available during the policy term or before the policy anniversary on which the age nearer birthday of the life assured is 70 years, whichever is earlier. If this rider is opted for, in case of accidental death, the Accident Benefit Rider Sum Assured will be payable as lumpsum along with the death benefit under the base plan. In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly installments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Sum Assured on Death under the base policy which is equal to Accident Benefit Sum Assured under the policy, shall be waived.

LIC’s Accident Benefit Rider

This rider can be opted for at any time within the premium paying term of the Base plan provided the outstanding premium paying term of the base plan is at least 5 years. The benefit cover under this rider shall be available only during the premium paying term. If this rider is opted for, in case of accidental death, the Accident Benefit Rider Sum Assured will be payable as lumpsum along with the death benefit under the base plan.

LIC’s New Term Assurance Rider

This rider is available at the inception of the policy only. The benefit cover under this rider shall be available during the policy term. If this rider is opted for, an additional amount equal to Term Assurance Rider Sum Assured shall be payable on the death of the Life Assured during the policy term.

LIC’s New Critical Illness Benefit Rider

This rider is available at the inception of the policy only. The cover under this rider shall available during the policy term. If this rider is opted for, on the first diagnosis of any one of the specified 15 Critical Illnesses covered under this rider, the Critical Illness Sum Assured shall be payable.

LIC’s Premium Waiver Benefit Rider

Under an in-force policy, this rider can be opted for on the life of proposer of the policy ( as the life assured is minor), at any time coinciding with the policy anniversary but within the premium paying term of the Base Policy provided the outstanding premium paying term of the Base Policy and the rider is at least 5 years. Further, this rider shall be allowed under the policy wherein the Life Assured is Minor at the time of opting for this rider. The Rider term shall not exceed ( 25 minus age of the minor Life Assured at the time of opting this rider).

If this rider is opted for, on the death of the proposer, payment of premiums in respect of base policy falling due after the date of death till the expiry of the rider term shall be waived. However, in such a case, if the premium paying term of the base policy exceeds the rider term, all the future premiums due under the base policy from the date of expiry of this Premium Waiver Benefit Rider term shall be payable by the Life Assured. On non- payment of such premiums the policy would become paid- up.

The premium for LIC’s Accident Benefit Rider or LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Critical Illness Benefit Rider shall not exceed 100% of premium under the

base plan and the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the base plan.

Each of the above Rider Sum Assured cannot exceed the Basic Sum Assured under the Base plan.

For more details on the above riders, refer to the rider brochure or contact LIC’s nearest Branch Office.

Option to take Death Benefit in installments:

This is an option to receive a death benefit in installments over the chosen period of 5 or 10 or 15 years instead of a lump-sum amount under an in-force as well as paid-up policy. This option can be exercised by the Policyholder during the minority of the Life Assured or by Life Assured aged 18 years and above, during his/her lifetime; for full or part of Death benefits payable under the policy. The amount opted for by the Policyholder/Life Assured (ie. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum installment amount for different modes of payments being as under:

Age (in years) Policy Term/Premium Paying Term (in Years) 16 (10) 21 (15) 25 (16) 20 16,699 10,682 9,006 30 16,758 10,770 9,134 40 17,013 11,133 9,584 50 17,826 12,123 10,741

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Policyholder/Life Assured, the claim proceeds shall be paid in lump sum only.

The interest rates applicable for arriving at the installment payments under this option shall be as fixed by the Corporation from time to time.

For exercising an option to take Death Benefit in installments, the Policyholder during the minority of the Life Assured or the Life Assured, if major, can exercise this option during his/her life while in the currency of the policy, specifying the period of Instalment payment and net claim amount for which the option is to be exercised. The death claim amount shall then be paid to the nominee as per the option exercised by the Policyholder/Life Assured and no alteration, whatsoever, shall be allowed to be made by the nominee.

What is the Payment of Premiums mode available for this Jeevan Labh Plan?

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly mode (through NACH only) or through SSS mode during the Premium Paying Term of the policy.

What is Grace Period for this Jeevan Labh Plan?

A grace period of 30 days will be allowed for payment of yearly, half-yearly, quarterly mode, and 15 days for monthly mode of premium payment from the date of the first unpaid premium. During this period, the policy shall be considered in force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

The above grace period will also apply to rider premiums which are payable along with a premium for the base policy.

How can I understand Sample Illustrative Premium?

The sample illustrative annual premiums for Basic Sum Assured of Rs. 2lakh/ for standard lives are as under:

Yearly mode 2% of Tabular Premium Half-yearly mode 1% of Tabular premium Quarterly, Monthly & SSS NIL

Mode Rebate:

Basic Sum Assured (B.S.A) Rebate (Rs.) 2,00,000 to 4,90,000 Nil 5,00,000 to 9,90,000 1.25% of B.S.A. 10,00,000 to 14,90,000 1.50% of B.S.A. 15,00,000 to and above 1.75% of B.S.A.

High Sum Assured Rebate:

Mode of Instalment payment Minimum installment amount Monthly Rs. 5,000/- Quarterly Rs. 15,000/- Half-Yearly Rs. 25,000/- Yearly Rs. 50,000/-

What is Revival for this plan?

If the premium is not paid before the expiry of the days of grace, the policy lapses. A lapsed policy can be revived within a period of 5 consecutive years from the date of the first unpaid premium and before the date of maturity, as the case may be. The revival shall be effected on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on the satisfaction of Continued Insurability of the Life Assured and/or Proposer ((if LIC’s Premium Waiver Benefit Rider is opted for) on the basis of the information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation reserves the right to accept at original terms, accept with modified terms, or decline the revival of a discontinued policy. The revival of discontinued policy shall take effect only after the same is approved by the Corporation and is specifically communicated in writing to the Life Assured.

The revival of rider(s), if any, will only be considered along with a revival of the Base Policy, and not in isolation.

What is Paid-up Value for this plan?

If less than two years’ premiums have been paid and any subsequent premium is not duly paid, all the benefits under this policy shall cease after the expiry of grace period from the date of first unpaid premium and nothing shall be payable.

If after at least two full years’ premiums have been paid and any subsequent premiums are not duly paid,

this policy shall not be wholly void but shall subsist as a paid-up policy till the end of the policy term.

The Sum Assured on Death under a paid-up policy shall be reduced to such a sum called ‘Death Paid-up Sum Assured’ and shall be equal to Sum Assured on Death multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable. In addition to the Death Paid-Up Sum Assured, vested simple reversionary bonuses if any shall also be payable on Life Assured’s prior death.

The Sum Assured on Maturity under a paid-up policy shall be reduced to such a sum called ‘Maturity Paid-up Sum Assured’ and shall be equal to Sum Assured on Maturity multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable. In addition to the Maturity Paid-Up Sum Assured, vested simple reversionary bonuses if any shall also be payable on the expiry of the policy term.

A paid-up policy shall not be entitled to participate in future profits. However, the vested simple reversionary bonuses, if any, shall remain attached to the reduced paid-up policy.

Rider(s) do not acquire any paid-up value and the rider benefits cease to apply if the policy is in lapsed condition.

What is Surrender and how I can surrender my policy?

The policy can be surrendered at any time provided two full years’ premiums have been paid. On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value or Special Surrender Value.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI.

The Guaranteed Surrender value during the policy term shall be equal to total premiums paid (excluding extra premiums, taxes, and premiums for riders, if opted for) multiplied by the Guaranteed Surrender Value factors applicable to total premiums paid. These Guaranteed Surrender Value factors expressed as percentages will depend on the policy term and policy year in which the policy is surrendered and are specified as below:

In addition, the surrender value of any vested simple reversionary bonuses, if any, shall also be payable, which is equal to vested bonuses multiplied by the Guaranteed Surrender Value factor applicable to vested bonuses. These factors will depend on the policy term and policy year in which the policy is surrendered and are specified as below:

What is Policy Loan?

A loan can be availed under the policy provided the policy has acquired a surrender value and subject to the terms and conditions that the Corporation may specify from time to time.

The interest rate to be charged for policy loan and as applicable for the entire term of the loan shall be determined at periodic intervals. The applicable interest rate shall be as declared by the Corporation based on the method approved by the IRDAI.

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

What are the tax benefits available for this plan?

Statutory Taxes, if any, imposed on such insurance plans by the Govt. of India or any other constitutional tax Authority of India shall be as per the Tax laws and the rate of tax as applicable from time to

The amount of applicable taxes, as per the prevailing rates, shall be payable by the policyholder on the premium(s) ( for base policy and rider(s), if any) including extra premium which shall be collected separately over and above in addition to the premium(s) payable by the policyholder. The amount of tax paid shall not be considered for the calculation of benefits payable under the plan.

- Regarding Income tax benefits/implications on the premium(s) paid and benefits payable under this plan, please consult your tax advisor for

What is Free-Look Period for this plan?

If the Policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to the Corporation within 15 days from the date of receipt of the policy bond stating the reasons for objections. On receipt of the same, the Corporation shall cancel the policy and return the amount of premium deposited after deducting the proportionate risk premium (for base plan and rider(s), if any) for the period of cover, expenses incurred on medical examination, special reports, if any and stamp duty charges.

What are the Exclusions for this plan?

Suicide:

This policy shall be void

- If the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk, the Corporation will not entertain any claim under this policy except for 80% of the total premiums paid, provided the policy is in force.

- If the Life Assured (whether sane or insane) commits suicide within 12 months from date of revival, an amount which is higher of 80% of the total premiums paid till the date of death or the Surrender Value available as on the date of death, shall be payable. The Corporation will not entertain any other claim under this

This clause shall not be applicable for a policy lapsed without acquiring paid-up value and nothing shall be payable under such policies.

Read to know more about this – LIC के जीवन लाभ प्लान में रोजाना 233 रुपये के निवेश से आप बनेंगे 17 लाख के मालिक, जानें क्या है पूरी स्कीम।

Also, read this – Why should We Buy LIC’s Jeevan Shanti Plan?

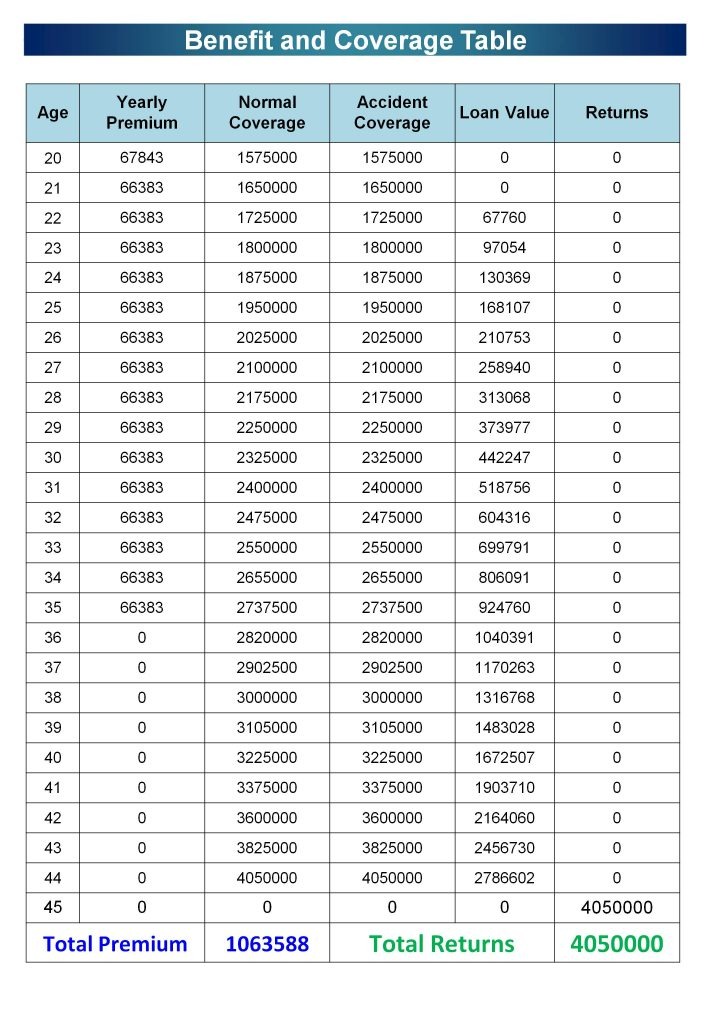

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.