LIC’s Aadhaar Shila Plan

Post Views: 4,642

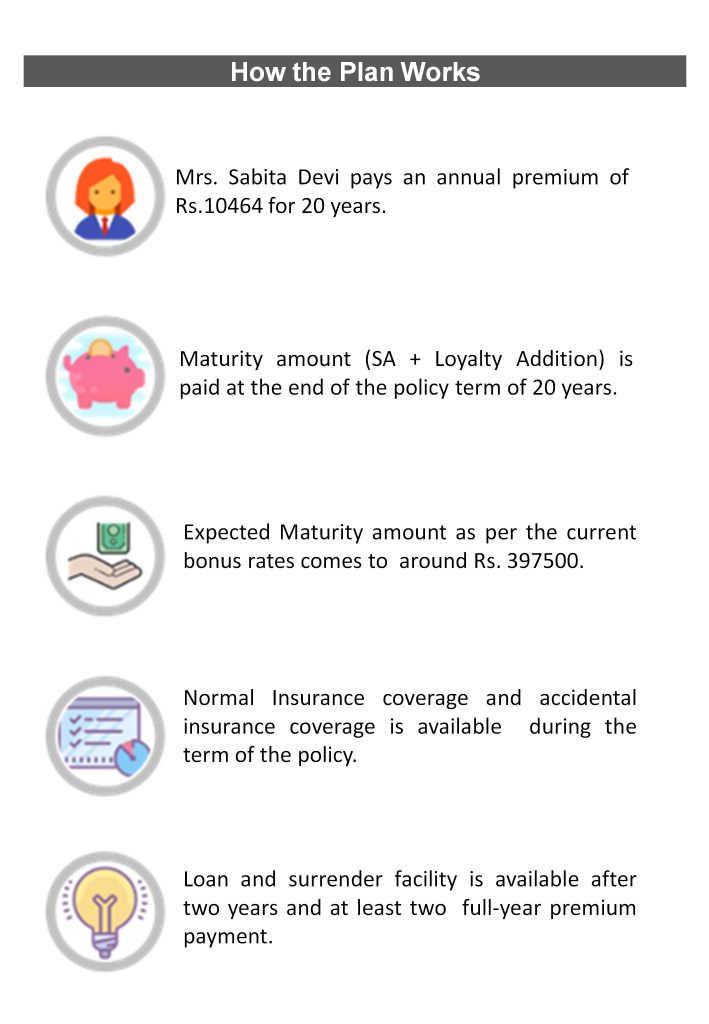

LIC’s Aadhaar Shila Plan No. 944 – is a non-linked, with profits and regular premium paying, participating, endowment plan. The Aadhaar Shila plan is an exclusive insurance plan for women who have a valid Aadhaar card issued by the Government of India. This plan is a combination of savings and protection. This is a Loyalty Addition based plan. The plan is available to standard healthy women without having to undergo any medical testing requirements. Under the Aadhaar Shila plan, the family of the policyholder receives financial support in the event of her sudden death before the end of the policy term. If the policyholder survives the term of the policy, the policyholder will receive a Lumpsum as a maturity benefit. The policy also offers a loan facility and automatic coverage to meet liquidity requirements. Here is everything you want to know.

| Plan No. |

944 |

| Launch Dated |

1 Feb 2020 |

Why we need such a Aadhaar Shila policy?

LIC’s Aadhaar Shila is a plan designed exclusively for female lives, which offers a combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the policyholder any time before maturity and a lump sum amount at the time of maturity for the surviving policyholder.

In addition, this plan also takes care of liquidity needs through its Auto Cover as well as loan facility.

What are the other benefits of this Aadhaar Shila plan?

Death Benefit Payable:

On the death of the Life Assured during the policy term provided the policy is in force:

On death during the first five years: “Sum Assured on Death” shall be payable.

On death after completion of five policy years but before the date of maturity: “Sum Assured on Death” and Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Death” is defined as the higher of

- 7 times of annualized premium; or

- 110% of Basic Sum

The death benefit shall not be less than 105% of total premiums paid up to the date of death. Premiums referred above shall not include any taxes, extra premium and rider premium, if any.

Maturity Benefit:

On Life assured surviving to the end of the policy term, provided the policy is in force, “Sum Assured on Maturity” along with Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Loyalty Addition:

Provided the policy has completed five policy years and at least 5 full years’ premium have been paid, then depending upon the Corporation’s experience the policies under this plan shall be eligible for Loyalty Addition at the time of exit in the form of Death during the policy term or Maturity, at such rate, and on such terms, as may be declared by the Corporation. Under a paid-up policy, Loyalty Addition shall be payable for the completed policy years for which the policy was in force.

In addition, Loyalty Addition, if any, shall also be considered in Special Surrender Value calculation on surrender of the policy during the policy term, provided the policy has completed five policy years and at least 5 full years’ premium have been paid.

What are the Eligibility Conditions and Other Restrictions?

(This plan is only available for standard healthy lives without undergoing any medical examination)

Minimum Basic Sum Assured per life*: Rs. 75,000

Maximum Basic Sum Assured per life*: Rs. 300,000

The Basic Sum Assured shall be in multiples of Rs.5,000/- from Basic Sum Assured Rs. 75,000 to Rs. 1,50,000/- and Rs.10,000/- for Basic Sum Assured above Rs.1,50,000/-.

Minimum Age at entry: 8 years (completed)

Maximum Age at entry: 55 years (nearest birthday)

Policy Term: 10 to 20 years

Premium Paying Term: Same as Policy Term

Maximum Age at Maturity: 70 years (nearest birthday)

* The total Basic Sum Assured under all policies issued to an individual under this plan shall not exceed Rs. 3 lakh.

What would be the Date of Commencement of risk?

Under this plan, the risk will commence immediately from the date of acceptance of the risk including minor lives.

What is the Date of Vesting under the Aadhaar Shila plan?

The policy shall automatically vest in the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

What are the Death Benefit Options available for this Aadhaar Shila plan?

The policyholder has the option of availing LIC’s Accident Benefit Rider under this plan at any time within the policy term of the Base plan provided the outstanding policy term of the base plan is at least 5 years. The benefit cover under this rider shall be available during the policy term or before the policy anniversary on which the age nearer birthday of the life assured is 70 years, whichever is earlier. If this rider is opted for, in case of accidental death, the Accident Benefit Rider Sum Assured will be payable as lumpsum along with the death benefit under the base plan.

The Rider Sum Assured cannot exceed the Basic Sum Assured under the Base plan.

For more details on the above riders, refer to the rider brochure or contact LIC’s nearest Branch Office.

Option to take Death Benefit in installments:

This is an option to receive a death benefit in installments over the chosen period of 5 or 10 or 15 years instead of a lump-sum amount under an in-force as well as paid-up policy. This option can be exercised by the Policyholder during the minority of the Life Assured or by Life Assured aged 18 years and above, during his/her lifetime; for full or part of Death benefits payable under the policy. The amount opted for by the Policyholder/Life Assured (ie. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum installment amount for different modes of payments being as under:

| |

|---|

| Mode of Installment Payment | Minimum Installment Amount |

| Monthly | Rs. 5,000/- |

| Quarterly | Rs. 15,000/- |

| Half-Yearly | Rs. 25,000/- |

| Yearly | Rs. 50,000/- |

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Policyholder/Life Assured, the claim proceeds shall be paid in lump-sum only.

The interest rates applicable for arriving at the installment payments under this option shall be as fixed by the Corporation from time to time.

For exercising the option to take Death Benefit in installments, the Policyholder during the minority of the Life Assured or the Life Assured, if major, can exercise this option during his/her life while in the currency of the policy, specifying the period of Installment payment and net claim amount for which the option is to be exercised. The death claim amount shall then be paid to the nominee as per the option exercised by the Policyholder/Life Assured and no alteration, whatsoever, shall be allowed to be made by the nominee.

What is the Payment of Premium Mode available?

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (monthly premiums through NACH only) or through salary deductions over the term of the policy.

How many days are available for Grace Period?

A grace period of 30 days will be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from the date of the first unpaid premium. During this period the policy shall be considered in-force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

The above grace period will also apply to rider premium which is payable along with a premium for the base policy.

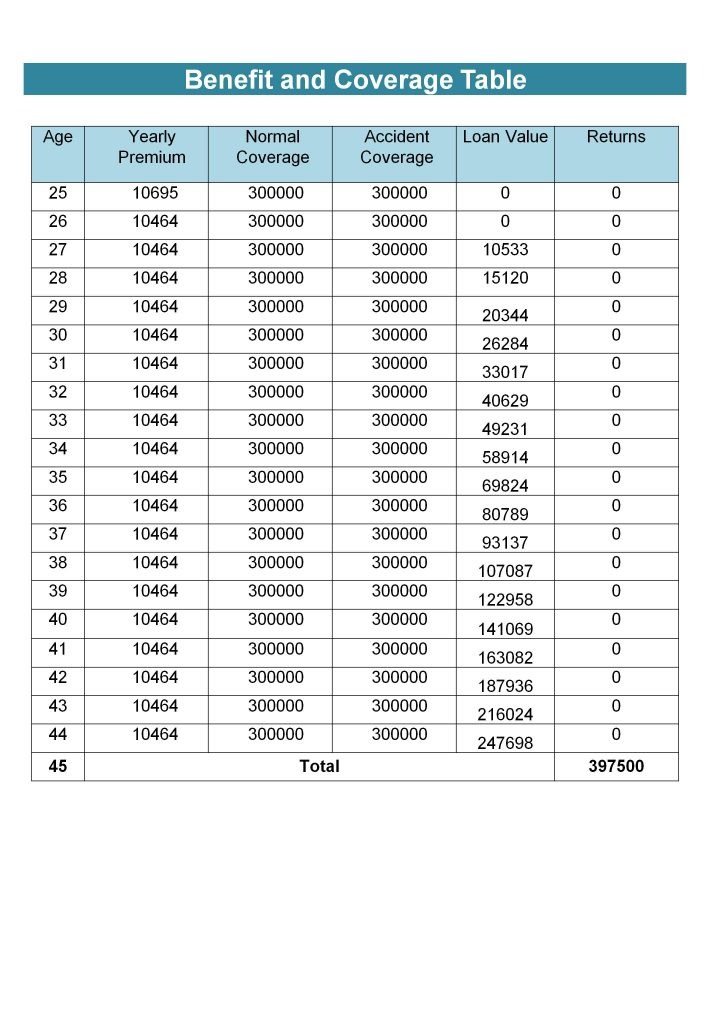

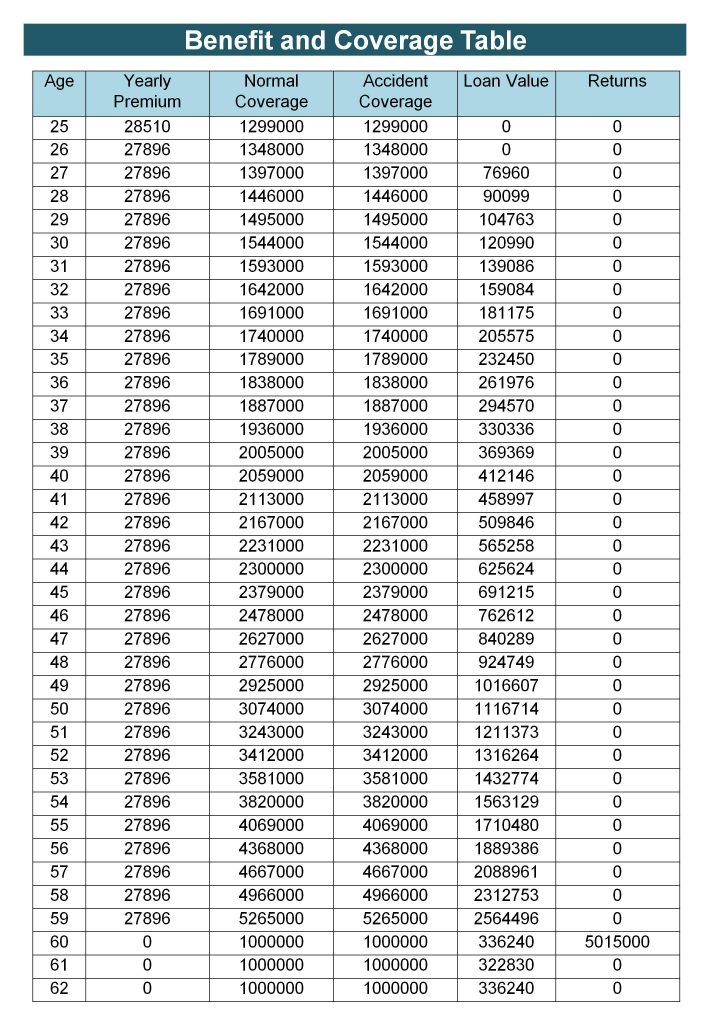

How can I understand through Sample Illustrative Premium?

The sample illustrative annual premiums for Basic Sum Assured of Rs 1 Lakh for Standard lives are as under:

| | | |

|---|

| AGE/ POLICY TERM | 10 | 15 | 20 |

| 10 | 8732 | 5248 | 3562 |

| 20 | 8761 | 5282 | 3597 |

| 30 | 8781 | 5312 | 3641 |

| 40 | 8874 | 5444 | 3817 |

| 50 | 9197 | 5841 | 4283 |

Rebates:

High Basic Sum Assured Rebate:

| |

|---|

| Basic Sum Assured (BSA) | Rebate (Rs.) |

| 75,000 to 1,90,000 | Nil |

| 2,00,000 to 2,90,000 | 1.50% of BSA |

| 3,00,000 | 2.00% of BSA |

Mode Rebate:

| |

|---|

| Yearly mode | 2% of Tabular Premium |

| Half-yearly mode | 1% of Tabular premium |

| Quarterly, Monthly (through NACH) & Salary deduction | NIL |

What is the Revival of Policy, how can I revive my policy?

If premiums are not paid within the grace period then the policy will lapse. A lapsed policy can be revived within a period of 5 consecutive years from the date of first unpaid premium but before the date of Maturity, as the case may be. The revival shall be effected on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on the satisfaction of Continued Insurability of the Life Assured on the basis of the information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured.

The Corporation reserves the right to accept at original terms, accept with modified terms, or decline the revival of a discontinued policy. The revival of discontinued policy shall take effect only after the same is approved by the Corporation and is specifically communicated in writing to the Life Assured.

The revival of rider, if opted for, will be considered along with the revival of the Base Policy, and not in isolation.

The Revival Period and Auto Cover Period (as mentioned in para 8 below) shall run concurrently

i.e. Auto Cover period does not extend the period of revival.

What is Paid-up Value?

If less than two years’ premiums have been paid and any subsequent premium is not duly paid, all the benefits under the policy shall cease after the expiry of grace period from the date of first unpaid premium and nothing shall be payable.

If, after at least two full years’ premiums have been paid and any subsequent premiums are not duly paid, the policy shall not be void but shall continue as a paid-up policy till the end of the policy term. However, if at least three full year’s premiums have been and any subsequent premiums are not duly paid, under such policies Auto Cover Period as mentioned below shall be applicable.

What is Auto Cover Period?

“Auto Cover Period” under a paid-up policy shall be the period from the due date of the first unpaid premium (FUP). The duration of the Auto Cover Period shall be as under:

- If at least three full years’ but less than five full years’ premiums have been paid under a policy and any subsequent premium is not duly paid: Auto Cover Period of six months shall be

- If at least five full years’ premiums have been paid under a policy and any subsequent premium is not duly paid: the Auto Cover Period of two years shall be available.

What are the benefits payable under a paid-up policy during the Auto Cover Period?

On Death:

The death benefit, as payable under an in-force policy, shall be paid after deduction of (a) the unpaid premium(s) in respect of the base policy with interest thereon up to the date of death, and (b) the balance premium(s) for the base policy falling due from the date of death and before the next policy anniversary, if any.

On maturity:

The Sum Assured on Maturity under paid-up policy shall be reduced to such a sum called “Maturity Paid-up Sum Assured” and shall be equal to Sum Assured on Maturity multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable i.e. [(Number of premiums paid / Total Number of premiums payable ) x (Sum Assured on Maturity)]. In addition to the Maturity Paid-up Sum Assured, Loyalty Addition, if any, shall also be payable on maturity.

What are the benefits payable under a paid-up policy after the expiry of the Auto Cover Period?

On death: Sum Assured on Death under a paid-up policy shall be reduced to such a sum, called “Death Paid-up Sum Assured” and shall be equal to Sum Assured on Death multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable .i.e. [Sum Assured on Death * (Number of premiums paid / Total number of premiums payable)]. In addition to the Death Paid-up Sum Assured, Loyalty Addition, if any, shall also be payable on death after the expiry of Auto Cover Period.

On maturity: The Sum Assured on Maturity under paid-up policy shall be reduced to such a sum called “Maturity Paid-up Sum Assured” and shall be equal to Sum Assured on Maturity multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable i.e.. [(Number of premiums paid / Total Number of premiums payable) x (Sum Assured on Maturity)].In addition to the Maturity Paid-up Sum Assured, Loyalty Addition, if any, shall also be payable on maturity.

Under a Paid-up policy, Loyalty Addition, if any, shall be payable for the completed policy years for which the policy was in force, provided the premium has been paid for at least 5 full years and after completion of 5 policy years.

Rider shall not acquire any paid-up value and rider benefit cease to apply if the policy is in lapsed condition.

What is Surrender and how can I surrender my Aadhaar Shila policy?

The policy can be surrendered at any time provided premiums have been paid for at least two consecutive years. On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value and Special Surrender Value.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI.

The Guaranteed Surrender Value payable during the policy term shall be equal to the total premiums paid (excluding extra premiums, taxes, and premiums for the rider, if opted for) multiplied by the Guaranteed Surrender Value factor applicable to total premiums paid under the policy.

These Guaranteed Surrender Value factors expressed as percentages will depend on the policy term and policy year in which the policy is surrendered.

What is a policy loan and how can I avail policy loans?

The loan can be availed during the policy term provided the policy has acquired a surrender value and subject to the terms and conditions as the Corporation may specify from time to time.

The interest rate to be charged for policy loan and as applicable for the entire term of the loan shall be determined at periodic intervals. The applicable interest rate shall be as declared by the Corporation based on the method approved by the IRDAI.

The maximum loan as a percentage of surrender value shall be as under:

- For in-force policies – up to 90%

- For paid-up policies – up to 80%

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

What is Tax implication?

Statutory Taxes, if any, imposed on such insurance plans by the Government of India or any other constitutional Tax Authority of India shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of applicable taxes as per the prevailing rates shall be payable by the policyholder on premiums payable (for base policy and rider if any including extra premiums, which shall be collected separately over and above in addition to the premiums payable by the policyholder. The amount of tax paid shall not be considered for the calculation of benefits payable under the plan

Regarding, Income tax benefits/implications on the premium(s) paid and benefits payable under this plan, please consult your tax advisor for details.

What is Free look period:

If the Policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to the Corporation within 15 days from the date of receipt of the policy bond stating the reasons for objections. On receipt of the same, the Corporation shall cancel the policy and return the amount of premium deposited after deducting the proportionate risk premium (for base plan and rider, if any) for the period of cover and stamp duty charges.

What are the Exclusions in this Aadhaar Shila plan?

Suicide: – This policy shall be void

- If the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk and the Corporation will not entertain any claim except for 80% of the total premiums paid, provided the policy is in force.

- If the Life Assured (whether sane or insane) commits suicide within 12 months from date of revival, an amount which is higher of 80% of the premiums paid till the date of death or the Surrender Value available as on the date of death, shall be payable. The Corporation will not entertain any other

This clause shall not be applicable for a policy lapsed without acquiring paid-up value and nothing shall be payable under such policy.

Advantage of High Sum Assured Rebate.

Advantage of High Sum Assured Rebate.

FAQs on LIC’s Jeevan Amar Plan

FAQs on LIC’s Jeevan Amar Plan

![]() WHY GO SOMEWHERE ELSE?

WHY GO SOMEWHERE ELSE?

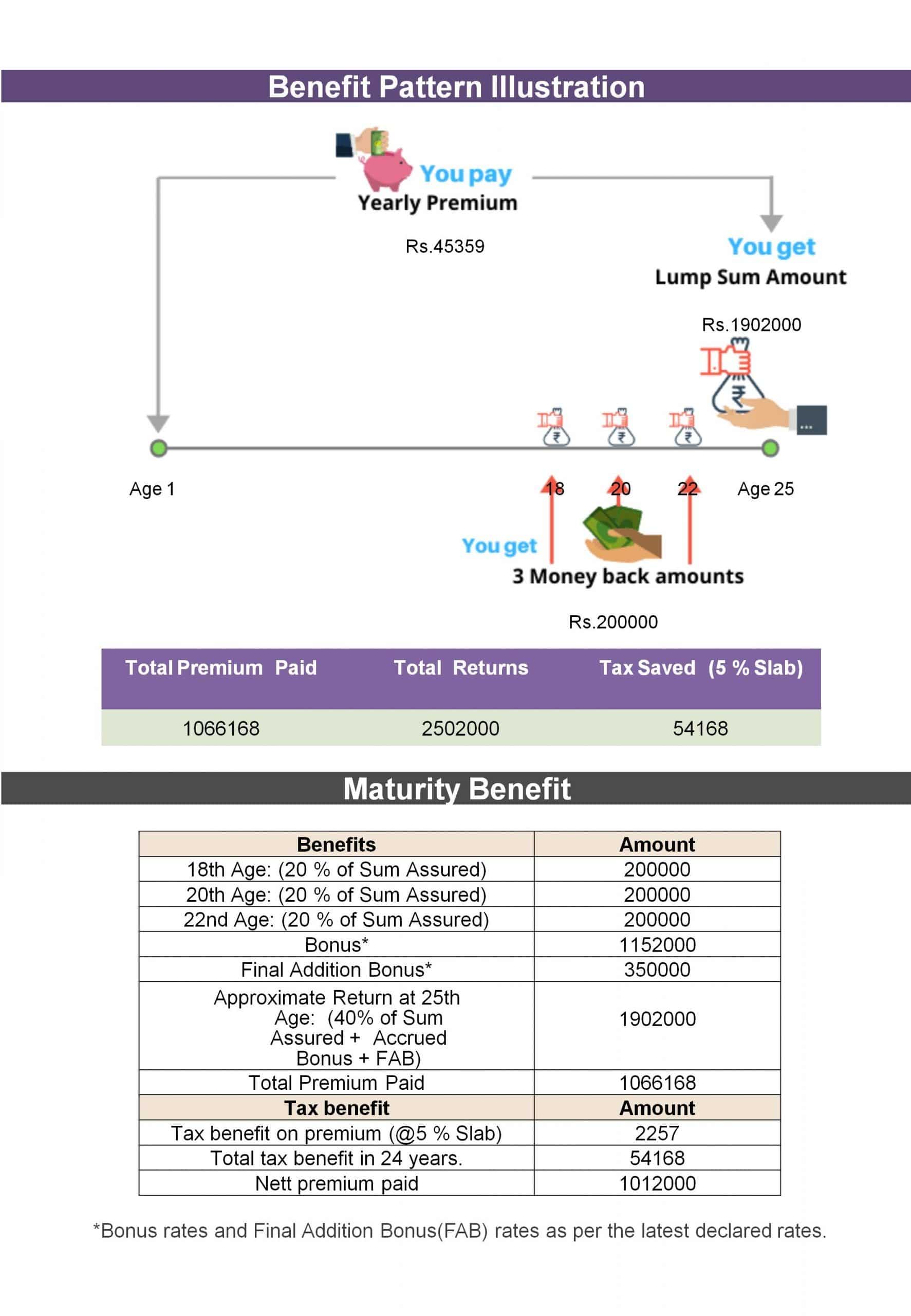

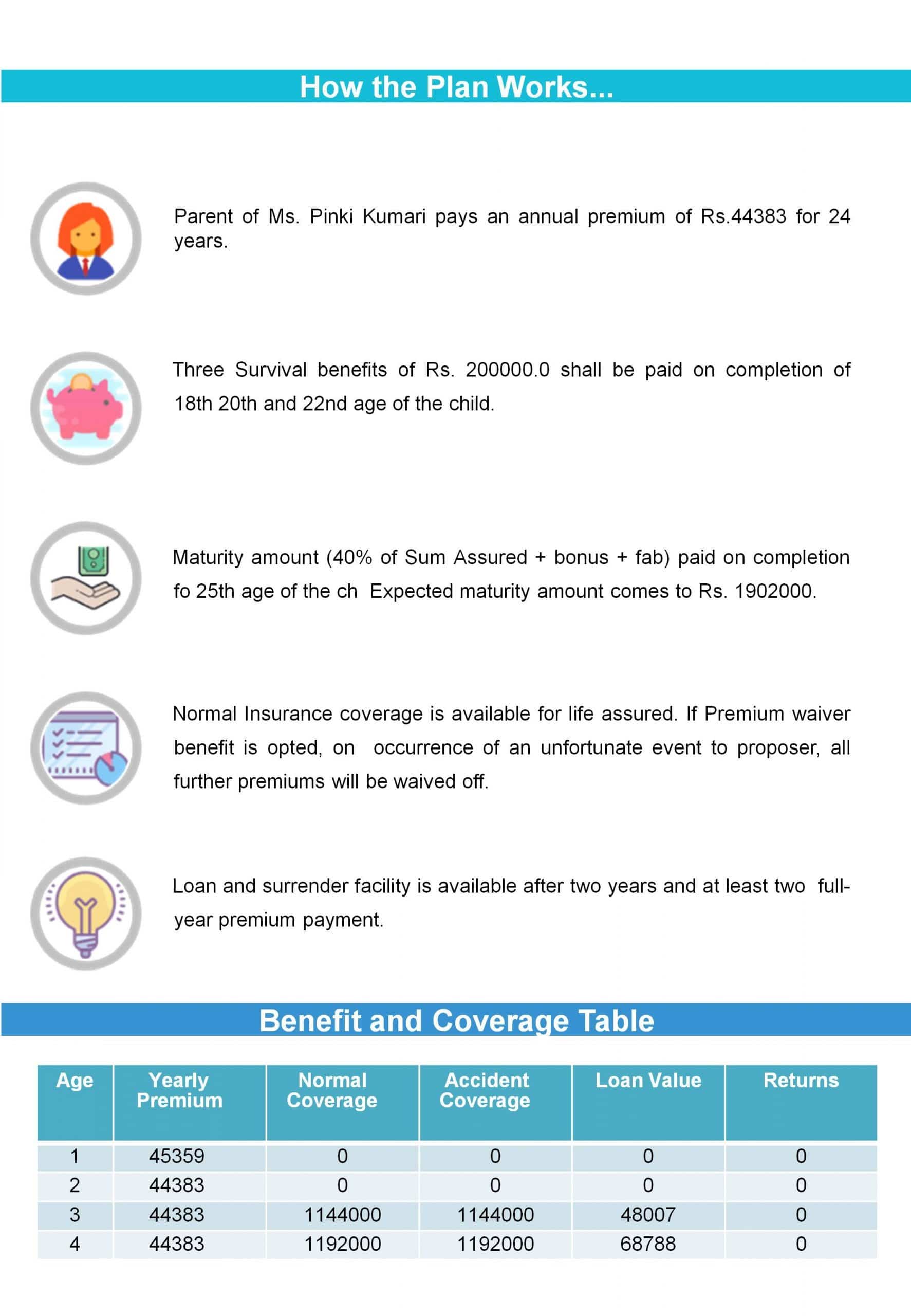

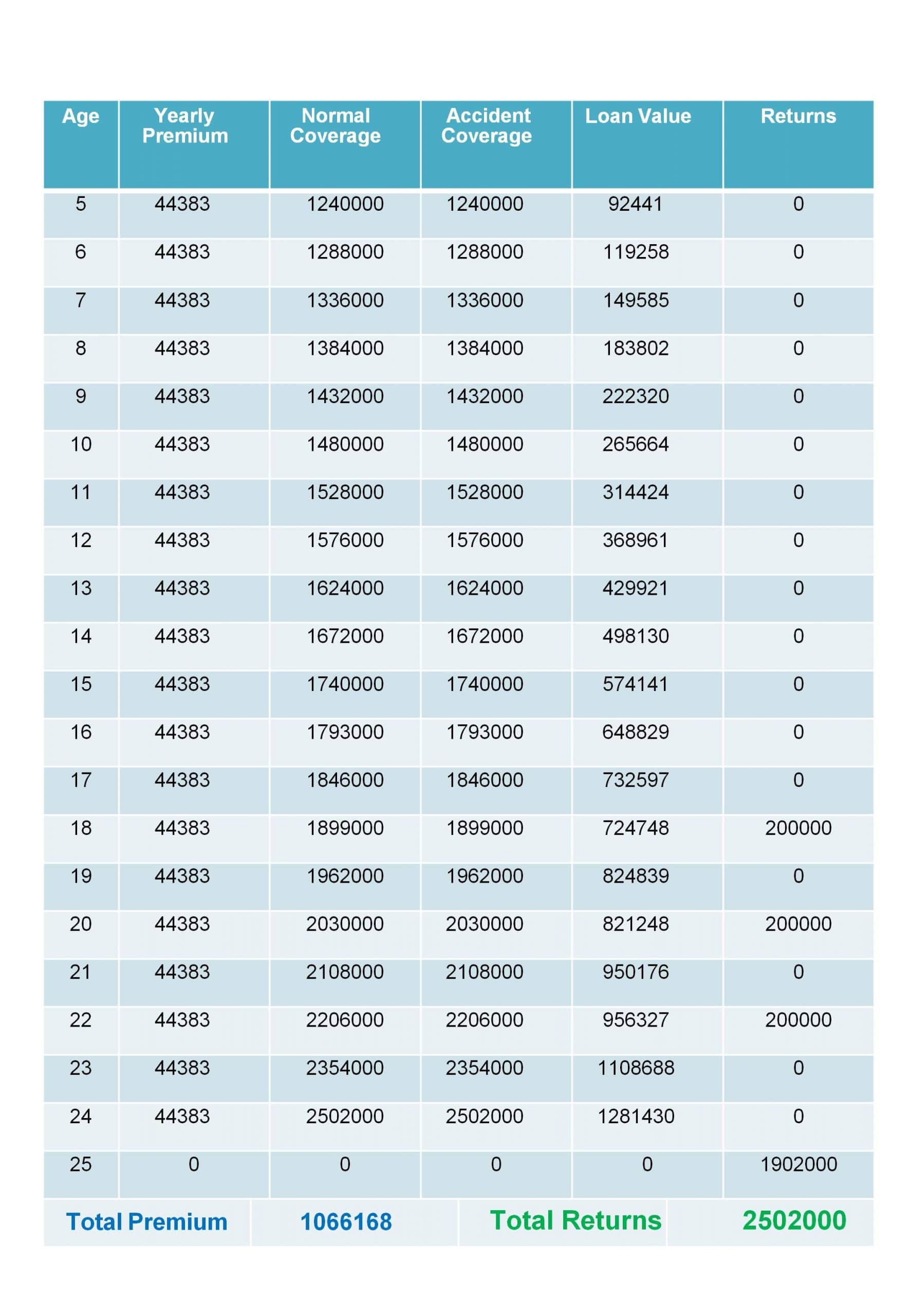

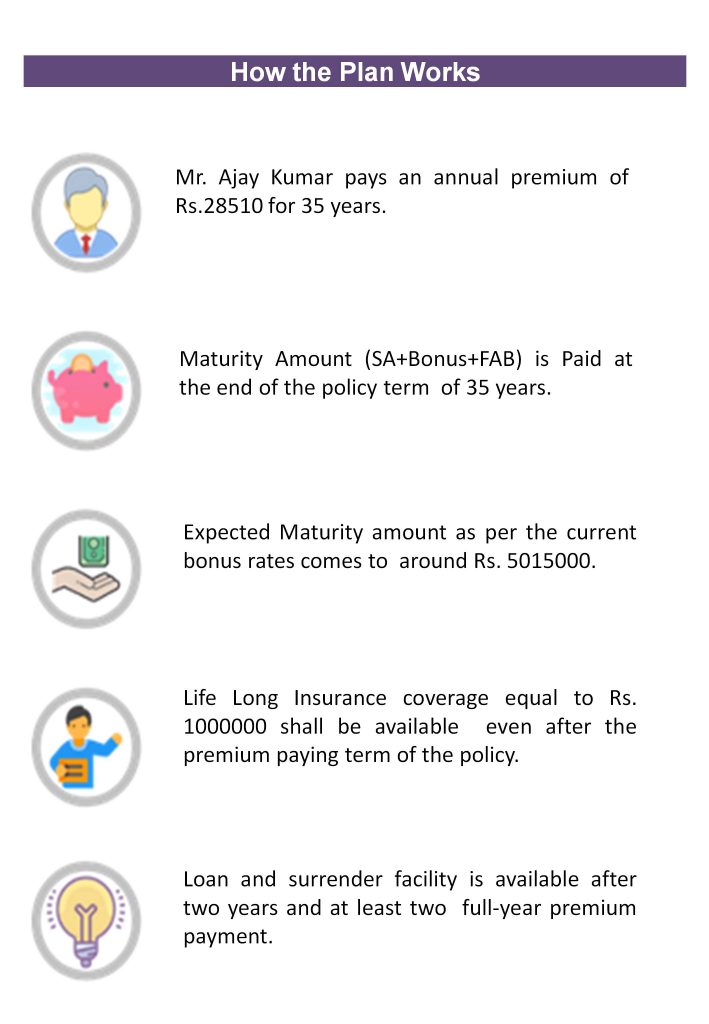

Nowadays when the costs of products and services are increasing day by day, children’s future must not suffer due to financial problems. Many children cannot fulfill their passions or dreams and some even cannot get higher studies due to financial problems.

Nowadays when the costs of products and services are increasing day by day, children’s future must not suffer due to financial problems. Many children cannot fulfill their passions or dreams and some even cannot get higher studies due to financial problems.