Why is LIC’s Cancer Cover Plan is Essential and Best?

LIC’s Cancer Cover Plan

LIC Cancer Cover Plan No. 905 – is an explicit, non-participating, and non-linked health insurance plan for the disease like Cancer. The LIC Cancer Cover plan requires regular payment of the premium that can be paid annually or semi-annually until the policy term ranges from 10 to 30 years. Cancer Cover Plan is a fixed benefit health plan that offers payments regardless of the costs incurred in treatment. Cancer Cover Plan ensures financial protection if the insured person is diagnosed during the policy term with any specified Early or Major Cancer. The policy can be purchased both online and offline. Most people find offline buying convenient because of the service. In recent years, cancer cases have increased in India at an alarming rate. In many health insurance policies, Cancer or critical illness is not specifically covered in the plan. As you know that Cancer treatment can take many months of hospitalization, and a normal health insurance plan is not adequate to cover expenses. At such times, the insurance company will provide benefits no matter how high the costs of the treatment. Here is everything you want to know.

| Plan No. | 905 |

| Launch Dated | 14 Nov 2017 |

Do you know?

Cancer cases have gone up in India at an alarming rate. Cancer is ‘eating away’ not just Indians but the country’s economy too. One in 10 Indians will develop Cancer in their lifetime, says WHO.

If a person is diagnosed with Cancer then he will need months of treatment and thus, the financial expenses will also be huge. It is estimated that for Cancer care including diagnosis, radiation, chemotherapy, hospitalization, etc. the cost can be anywhere from Rs. 5 lakhs to Rs. 25 lakhs for just a period of 6 months.

What is Cancer?

Our body’s cells begin to divide without stopping and spread into surrounding tissues. Cancer can start almost anywhere in our body which is made up of trillions of cells. Generally, human cells grow and divide to form new cells as the body needs them. When cells grow old or become damaged, they die, and new cells take their place.

Cancer can start almost anywhere in our body which is made up of trillions of cells. Generally, human cells grow and divide to form new cells as the body needs them. When cells grow old or become damaged, they die, and new cells take their place.

When Cancer develops in our body, this orderly process breaks down. As cells become more and more abnormal, old, or damaged cells survive when they should die, and new cells form when they are not needed.

What is Cancer Statistics in India?

- 7,84,821 – Cancer-related deaths

- 1 woman dies of Cervical Cancer every 8 minutes in India.

- Every 2 women newly diagnosed with breast cancer, one woman dies of it in India.

- Mortality due to tobacco use in India is estimated at upwards of 3500 persons every day.

- Tobacco (smoked and smokeless) use accounted for 3,17,928 deaths (approx) in men and women in 2018.

- Estimated no. of people living with the disease: around 2.25 million.

- Every year, new Cancer patients registered: Over 11,57,294 lakh

What is the need of this Cancer Cover Plan?

Most of the company does not cover Cancer or Critical Illnesses in the plan. Treatment of Cancer may require many months of hospitalization. The standard health insurance plan is not adequate to cover all these expenses because the treatment of cancer is expensive. It solely depends upon the Cancer stage. You don’t think that there should be a specific health plan to take care of these expenses?

Yes, LIC of India has come up with a Cancer-specific health plan known as Cancer Cover.

What does this Cancer Cover Plan offer?

This plan offers a fixed benefit payout for the treatment of Cancer. If the policyholder is diagnosed with Cancer, this plan will provide benefits irrespective of the costs incurred in the procedure.

It protects in the case of Early Stage and Major Stage Cancer.

LIC’s Cancer Cover Plan is a regular premium plan in which premiums can be paid yearly or half-yearly till policy term ranging from 10 to 30 years. It can be purchased offline as well as online. If you are going online then you have to be smart enough to buy it. If you are going offline then there is someone who will assist you, guide you at every stage. You need not worry. The choice is yours!

How many options are available for this Cancer Cover Plan?

LIC’s Cancer Cover offers 2 plan options. Obviously, the benefits will vary accordingly.

Option 1 – Level Sum Insured:

In this option, the Basic Sum Insured shall remain unchanged throughout the policy term. So, if you choose a cover of Rs. 10 lakhs, means it will be the same until the policy term.

Option 2 – Increasing Sum Insured:

In this option, the amount of cover you choose increases by 10% of the Basic Sum Insured every year until the first 5 years. If the policyholder is diagnosed with Cancer this increase will stop even within the first 5 years. So if you have taken a 30 lakhs cover, it will keep increasing by Rs. 3 lakh every year for 5 years (so it can go to a maximum of Rs. 45 lakhs). If you are diagnosed with Cancer after the increased Cover has reached Rs. 39 lakhs, it would not increase in the next 2 years.

The sum insured can be as high as Rs 50 lakh in this plan. So, if you take a Cover of 50 lakh with option 2 that is of No Use. In this case, option 1 is perfect. Do you know that you pay more premiums for option 2 than the premium for option 1. So, be cautious while selecting the option.

You can understand that the benefits payable under this plan shall be based on the Applicable Sum Insured that shall be equal to:

Option I – Basic Sum Insured for policies taken

Option II – Basic Sum Insured during the first year and increased sum insured after that

What are the benefits of this Cancer Cover Plan?

The benefits are based on the stage of Cancer, you have been detected with:

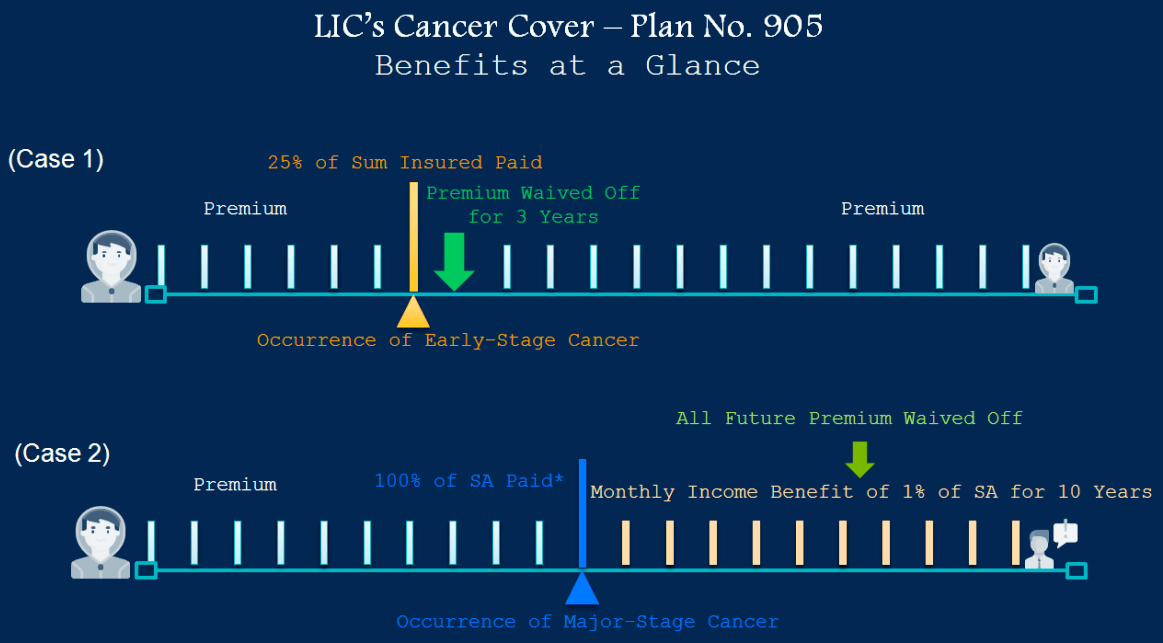

Early Stage Cancer

You get the following benefits if you are detected with Early-stage Cancer. You cannot decide. There is a specified list provided your medical report should match.

- Lumpsum Benefit: 25% of Applicable Sum Insured will be paid

- Premium Waiver Benefit: Premiums for next 3 policy years or balance policy term whichever is lower, shall be waived off from the policy anniversary coinciding or following the date of diagnosis.

Major Stage Cancer

You get the following benefits if you are detected with Major Stage Cancer. Here also, you cannot decide. There is a specified list provided your medical report should match.

Lumpsum Benefit: 100% of Applicable Sum Insured less any previously paid claims in respect of Early Stage Cancer is paid to you.

- Income Benefit: 1% of Applicable Sum Insured shall be payable on each policy month following the payment of Lumpsum amount for a fixed period of next 10 years irrespective of the survival of the policyholder and even if this period of 10 years goes beyond the policy term. This is great financial support. In case of mishappening of the policyholder while receiving this Income Benefit, the remaining payouts, if any, will be paid to his/her nominee.

- Premium Waiver Benefit: All the future premiums shall be waived from the next policy anniversary, and the policy shall be free from all liabilities except to the extent of Income Benefit as specified above.

Tax Benefit

The premiums paid for LIC’s Cancer Cover are eligible for tax deductions under Section 80D of the Income Tax Act for up to the limit of INR 50,000.

What is Covered in this Cancer Cover Plan?

The following are the conditions that are covered under the LIC Cancer Cover Plan. The diagnosis of the listed below conditions must be verified through histological evidence and be confirmed by a specialist Cancer Doctor.

Carcinoma-In-Situ (CIS)

Carcinoma-in-situ means the existence of malignant Cancer cells that remain within the cell group from which they ascended. It must consist of the full thickness of the epithelium, but not cross basement membranes and invade the surrounding tissue or organ. The diagnosis of the same must be positively recognized by the microscopic examination of fixed tissues.

Prostate Cancer–Early Stage

Early Prostate Cancer that is histologically described using the TNM classification as T1N0M0 with a Thyroid Cancer – Early Stage

All thyroid Cancers which are less than 2.0 cm and histologically classified as T1N0M0 as per the TNM classification.

Bladder Cancer – Early Stage

All tumors of the urinary bladder histologically categorized as TaN0M0 as per the TNM classification.

Chronic lymphocytic Leukaemia –Early Stage

Chronic Lymphocytic Leukaemia classified as stage zero to two as per the Rai staging is acceptable.

Cervical Intraepithelial Neoplasia

Severe Cervical Dysplasia described as Cervical Intraepithelial Neoplasia 3 (CIN3) on cone biopsy.

Major Stage Cancer

A malignant tumor characterized by the unrestrained growth and spread of malignant cells with the purpose of invasion and destruction of normal tissues. This diagnosis must be backed by histological evidence of malignancy. The term cancer includes leukemia, lymphoma, and sarcoma.

Cancer Cover Plan Examples

Let us understand the benefits of this Cancer Cover Plan with the help of a few examples.

Example 1

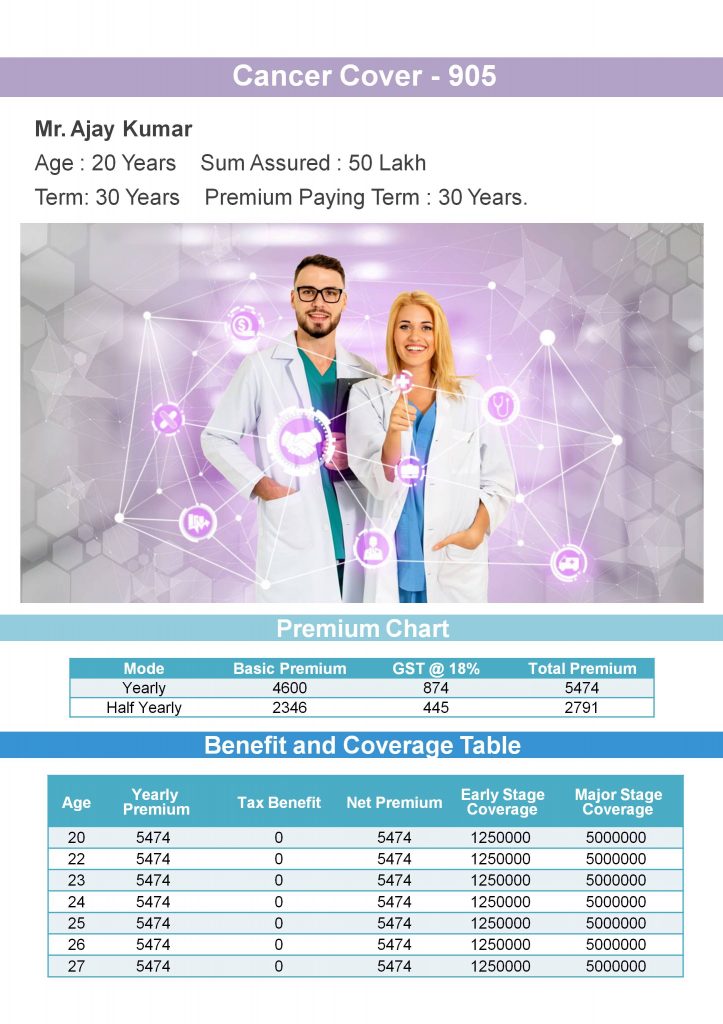

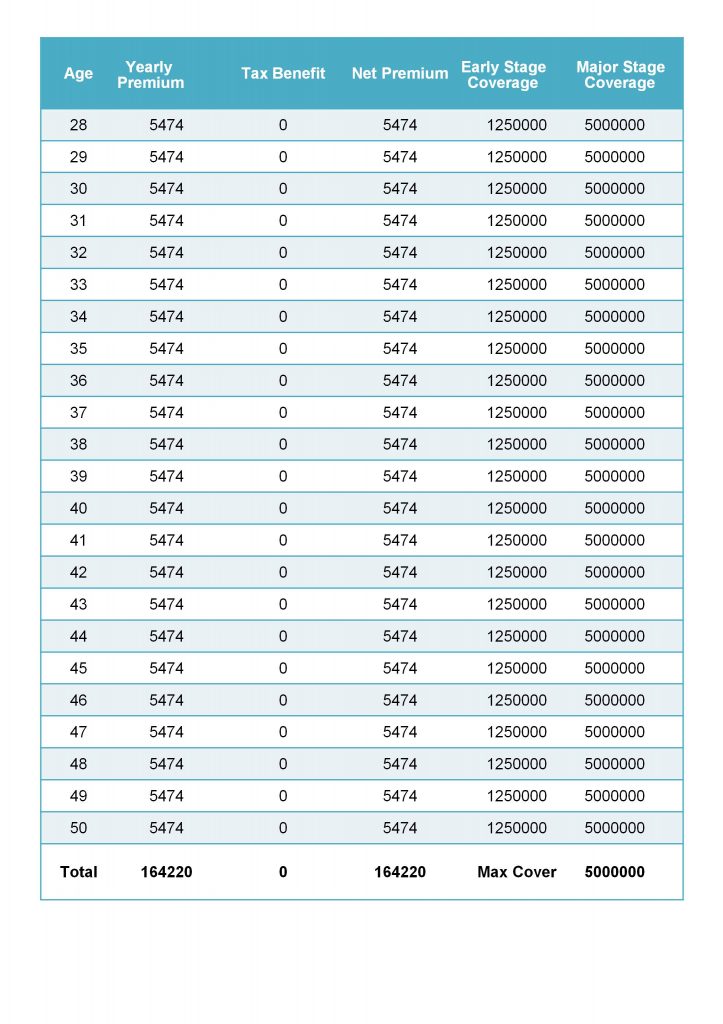

Suppose Mr. Ajay Kumar, who is 20 years old, has taken this plan with a Basic Cover of Rs. 50 lakhs for a policy term of 30 years with Option 1. He will have to pay Rs. 4,600 + taxes every year as annual premiums. The premiums will not change for the 1st five years but may be revised after that.

In case, he is diagnosed with an Early-stage Cancer, which is covered in this plan, he will get the following benefits:

Rs. 12.50 lakhs as lumpsum (25% of the Cover amount). The next 3 premiums will be waived off.

Example 2

Now suppose Mr. Ajay Kumar is directly diagnosed with a Major Stage Cancer which is covered by this plan, he will get the following benefits:

Rs. 50 lakhs as lumpsum (100% of the Cover amount) Rs. 50,000 every month for the next 10 years. Even if the policy term is over, he will get this money every month. If he passes away during these 10 years, his nominee will get the monthly payout. All future premiums are waived off

Example 3

Now suppose Mr. Ajay Kumar was first diagnosed with Early Stage Cancer and then, later on, it developed into a Major Stage Cancer. In such a scenario, the benefits would be as follows:

On detection of Early Stage Cancer, he will get the following benefits:

Rs. 12.5 lakhs as lumpsum (25% of the Cover amount). The next 3 premiums will be waived off. Now in case of Major stage of Cancer, he would get the following benefits:

Rs. 37.5 lakhs as lumpsum (75% of Cover amount as 25% is already paid earlier) Rs. 50,000 every month for the next 10 years. Even if the policy term is over, he will get this money every month. If he passes away during these 10 years, his nominee will get the monthly payout. All future premiums are waived off.

Is there any condition with this Cancer Cover Plan?

Early Stage Cancer Benefit shall be payable only once for the first-ever event, and policyholder shall not be entitled to make another claim for the Early Stage Cancer of the same or any other Cancer. However, the coverage for the Major Stage Cancer under the policy shall continue until the policy terminates.

Once a Major Stage Cancer Benefit is paid, no payment for any future claims under Early Stage Cancer or Major Stage Cancer would be admissible.

The total benefit under the policy, including Early Stage Cancer Benefit and Major Stage Cancer Benefit as specified above, shall not exceed the maximum claim amount of 220% of Applicable Sum Insured. If the policyholder claims for different stages of the same Cancer at the same time, the benefit should only be payable for the higher claim admitted under the policy. If there is more than one Cancer diagnosed in an event, the Corporation will only pay one benefit. That benefit will be the amount relating to the stage of Cancer, which has the highest benefit amount.

Waiting Period in Cancer Cover Plan:

A waiting period of 180 days will apply from the date of issuance of policy or date of revival of risk Cover, whichever is later, to the first diagnosis of any stage Cancer. “Any stage” here means all stages of Cancer that occur during the waiting period. No benefit shall be payable if any stage of Cancer occurs before the expiry of 180 days from the date of issuance of policy or date of revival, and the policy shall terminate.

Survival Period in Cancer Cover Plan:

No benefit shall be payable if the policyholder dies within a period of 7 days from the date of diagnosis of any of the specified Early Stage Cancer or Major Stage Cancer. The 7 days survival period includes the date of diagnosis.

What are the eligibility conditions & other restrictions?

| Minimum | Maximum | |

| Age at Entry (Years) | 20 (Completed) | 65 (Last Birthday) |

| Policy Term (Years) | 10 | 30 |

| Age at Maturity (Years) | 30 | 75 |

| Basic Sum Assured(Rs) | Rs. 10,00,000 | Rs. 50,00,000 |

| Minimum Premium (Rs) | 2,400/- for all modes (Yearly and Half-Yearly) |

What are the other conditions in this Cancer Cover Plan

- Paid-up Value of LIC’s Cancer Cover: This policy shall not acquire any paid-up value.

- Surrender Value of LIC’s Cancer Cover: No surrender value will be available under this plan.

- Policy Loan: No loan facility will be allowed under this plan.

- Free-look period: You have 15 days (30 days if a policy is purchased online) from the date of receipt of the policy bond, stating the reasons for objections. On receipt of the same, the Corporation shall cancel the policy and return the amount of premium deposited after deducting the proportionate risk premium for the period on Cover, (shall not be applicable during the waiting period) and charges for stamp duty.

What are the Exclusions in this Cancer Cover Plan?

Any Pre-Existing Condition:

- If the diagnosis of a Cancer was made within 180 days from the date of issuance of policy or date of revival of risk cover whichever is later.

- For any medical conditions suffered by the policyholder or any medical procedure undergone by the policyholder if that medical condition or that medical procedure was caused directly or indirectly by Acquired Immunodeficiency Syndrome (AIDS), AIDS-related complex or infection by Human Immunodeficiency Virus (HIV).

- For any medical condition or any medical procedure arising from the donation of any of the policyholder’s organs.

- For any medical conditions suffered by the policyholder or any medical procedure undergone by the policyholder, if that medical condition or that medical procedure was caused directly or indirectly by alcohol or drug (except under the direction of a registered medical practitioner).

- For any medical condition or any medical procedure from nuclear contamination, the radioactive, explosive, or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accidents arising from such nature.

What are the Documents required to buy this Cancer Cover Plan?

The following documents are required to buy this plan:

- Identity Proof – Any government ID like Aadhaar card, Pan card, Voter card, driving license, etc.

- Income Proof – Salary slip of last 3 months or CA certified balance sheet

- Age Proof – PAN Card, Birth Certificate

- Bank Details – Cancelled Cheque

- Address Proof – Electricity, Phone Bill

- Nominee Details – ID Card and Address Proof, if needed

What are the Procedures to Claim under this Cancer Cover Plan?

The following is the claim process of LIC’s Cancer Cover.

Claim Intimation:

You will need to first intimate LIC’s about the claim. This can be done by filing a claim form which is available on the official website of the Life Insurance Corporation. You can also visit the nearest LIC branch and fill the claim intimation form. You will also be required to submit supporting documents like diagnosis report and other medical documents to support your claim.

Claim Processing:

After receiving your claim form and supporting documents, the assessor will verify the same and evaluate if the claim falls in the scope of the policy. If any more documents are required, the policyholder will be asked to submit the same. The requirement of documents may differ case to case wise.

Claim Settlement:

Once the evaluation process of the documents submitted is done by LIC, its decision will be communicated to the policyholder. The claim can either be get approved or rejected. In some cases, the insurance company may ask for more documents before approving. LIC has an excellent claim settlement ratio, and all the claims are settled in a timely manner. The claim amount will be sent through ECS or NEFT to the policyholder.

What is the Documents Requirement for Claiming under this Cancer Cover Plan?

- The document may differ from case to case, but the basic documents required are mentioned below.

- Claim Form duly signed with the Original Policy document

- Hospital Treatment Certificate/Discharge Summary

- Confirmatory Medical Reports like Radiology, Histology and Laboratory Evidence

Read to know more about this – रोजाना 9 रुपए खर्च पर खरीदें LIC की ये खास पॉलिसी, जानलेवा बीमारी से बचाव में करेगी मदद।

Read to know more about this – कैंसर का इलाज कर देता है कंगाल, LIC से लें 300 रुपये महीने का बीमा प्लान।

Read to know more about this – एलआईसी के कैंसर कवर प्लान में सिर्फ 7 रुपये रोजाना के निवेश पर पाएं 10 लाख रुपये की मदद, जानें- क्या हैं फायदे और नियम।

Also, read this – Top Reasons Why Insurance is Important in Our Everyday Life?

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.

Famous Celebrities Cancer Victim/Survivor

- Aadesh Shrivastava – Malignant Cancer

- Anurag Basu – Leukaemia; Blood Cancer

- Feroz Khan – Lung Cancer

- Irrfan Khan – Neuroendocrine Cancer

- Lisa Ray – Multiple Myeloma Cancer

- Manisha Koirala – Ovarian Cancer

- Manohar Parrikar – Pancreatic Cancer

- Mumtaz – Breast Cancer

- Nargis Dutt – Pancreatic Cancer

- Rajesh Khanna – Gall Bladder Cancer

- Rakesh Roshan – Carcinoma; Throat Cancer

- Rishi Kapoor – Blood Cancer

- RR Patil – Oral Cancer

- Simple Kapadia – Cancer

- Sonali Bendre – Metastatic cancer

- Tahira Kashyap – Breast Cancer

- Vinod Khanna – Bladder Cancer

- Yuvraj Singh – Lung Cancer

- Ben Stiller – Prostate Cancer

- Betsey Johnson – Breast Cancer

- Christina Applegate – Breast Cancer

- Colin Powell – Prostate Cancer

- Cynthia Nixon – Breast Cancer

- Dr. Drew Pinsky – Prostate Cancer

- Fran Drescher – Uterine Cancer

- Hugh Jackman – Skin Cancer

- Jane Fonda – Breast Cancer

- Janice Dickinson – Breast Cancer

- Joan Lunden – Breast Cancer

- Julia Louis-Dreyfus – Breast Cancer

- Kathy Bates – Ovarian Cancer

- Lance Armstrong – Testicular Cancer

- Larry King -Lung Cancer

- Melissa Etheridge – Breast Cancer

- Michael Douglas – Throat Cancer

- Olivia Newton-John – Breast Cancer

- Phil Lesh – Prostate Cancer

- Robin Quivers – Endometrial Cancer

- Robin Roberts – Breast Cancer

- Sandra Lee – Ductal Carcinoma in Situ DCIS), Breast Cancer

- Shannen Doherty – Breast Cancer

- Shannon Miller – Ovarian Cancer

- Sharon Osbourne – Colon Cancer

- Sheryl Crow – Breast Cancer

- Tommy Chong – Colorectal Cancer

- Val Kilmer – Throat Cancer

- Wanda Sykes – Breast Cancer

Why should We Buy LIC's Cancer Cover?

- Cancer Cover is highly competitive with the private company’s similar plan.

- LIC’s claim settlement is world-class and hence, Cancer Cover with the LIC brand name makes it incomparable.

- Hassle-free acceptance of Cancer Cover proposal. A nonmedical scheme up to Rs 50 lac is also available.

- Income proof is not required.

- Claim Settlement is direct with LIC and not through TPA.

- The benefit of entry age in case of premium revision makes this plan more affordable against Mediclaim Plan.

Any Idea about the Cost of Cancer Treatment?

- Bone marrow transplant – Treatments involving Bone marrow transplant would cost anything between Rs 25 lakh and Rs 35 lakh.

- Chemotherapy – Rs 50000/- to Rs 100000/ (per session) Depending on the stage of cancer, a minimum of 4 to 6 cycles of chemotherapy is required.

- Diagnosis Test – It is estimated that the diagnostics for Cancer i.e. CT Scans, PET Scans, MRIs for the Brain, FNAC, Biopsy, and other diagnostics come up to almost Rs. 1,50,000/- according to leading corporate hospitals.

- Hormone Therapy – The cost of quarterly maintenance of hormone therapy ranges from Rs 20,000 to Rs 50,000 for an injection of Zoladex, Lucrin, Eligard, and Pamorelin.

- Immunotherapy- As per the American Society of Clinical Oncology(ASCO), immunotherapy would cost more than $1 million per patient per year at a higher dose. This therapy is effective to treat lung, head, and neck, kidney, bladder, and skin cancer.

- Radiation Therapy – Rs. 1,00,000 /- to Rs 1, 50,000/- for one round of radiation treatment. Depending on the severity more Radiation cycles may be required.

- Treatment – Depending on the Organ affected and the Stage, treatment would cost as low as Rs 5 lakh for 6 months of treatment to as high as Rs 25- 35 lakh.

Other Things that Increase the Cost:

- Cost of diet.

- Family and Living Expenses.

- Loss of wages or income.

- The nursing facility required at home.

- One has to find out how long the treatment will continue.

- One may need to pay for lodging as well.

- Repayment of the loan if any.

- Transportation and travel cost to get the treatment.

- What specific drugs will be required?

The average cost ranges from 5 lakhs to 45 lakhs.

Why is Cancer Cover Supplementary & Not Substitute to Mediclaim?

- Waiting Period from 2 to 3 years.

- No reimbursement of traveling and lodging expenses involved.

- No Premium Waiver benefit.

Mediclaim will cover initial medical expenses and Surgical expenses. - It will not pay for loss of income.

- It may not cover the full amount spent due to sub-limits or caps on various heads.

- The claim will be restricted to the amount insured.

- Buying a higher cover will be costlier.

FAQs on LIC’s Cancer Cover Plan

FAQs on LIC’s Cancer Cover Plan

Dummy

Am I eligible for this plan, if I smoke cigarette or use tobacco?

What are the modes of premium payment?

How can I buy the Cancer Policy?

What rebates are available under the plan?

Where can I get the medical test done for availing this plan?

Are pre-existing diseases covered in this plan?

Is there tax benefit available for premium payment in this plan?

Does the Cancer Cover policy lapse?

Is it difficult to get Cancer plan in case my family has a history of Cancer?

What happens if I discontinue paying a premium towards my Cancer insurance policy?

What if I am not happy with the LIC Cancer Cover policy after purchasing it?

What is the grace period offered under the plan?

What is meant by ‘Survival Period’ in the LIC Cancer Cover plan?

How many times can I claim for early-stage Cancer in the LIC Cancer Care policy?

What are the terms of revival of Cancer Cover Policy?

What are the documents required for the reviving lapsed policy?

Does Cancer Cover policy acquired paid-up value?

Can Cancer Cover policy be surrendered?

Can policy loan be availed on Cancer Cover policy?

What are the plan exclusions?

- Any expenses for diagnostic purposes or a medical examination or check-up.

- Any natural calamities like earthquake, fire, flood, etc.

- Any pre-existing ailments that were not disclosed at the time of policy inception, which could have resulted directly or indirectly to increase the premium.

- Any sickness from an epidemic.

- Any surgical procedure not performed by a registered physician or for an experimental purpose.

- Attempted suicide.

- Cosmetic surgery, plastic surgery (other than what is necessary after an accident), change of gender surgery, treatment for any congenital illnesses, circumcision, etc.

- Dental treatment or surgery (other than what is necessary after an accident).

- Medical termination of pregnancy, childbirth, or pre and post-natal ailments of the mother or the newborn.

- Non-allopathic treatment.

- Participation in any hazardous sports or activities like deep-sea diving, mountaineering, skydiving, scuba diving, bungee jumping, etc.

- Regular or routine medical check-up.

- Self-inflicted ailments.

- Sexually transmitted ailments.

- Surgery related to organ donation.

- Taking active participation in criminal activity.

- Treatment due to an improper following of the medical advice.