Why is LIC’s New Jeevan Anand Plan the Best Choice for Young Couple?

LIC’s New Jeevan Anand Plan

LIC New Jeevan Anand Plan No. 915 – is a participating, non-linked, traditional savings cum insurance cover scheme. LIC New Jeevan Anand policy has an average premium, high bonus rate, and great features. The scheme presents an attractive combination of security and savings. This combination provides financial protection against death for the life of the policyholder, with the provision of Lumpsum payment at the end of the selected policy term in the event of survival. Risk coverage under LIC New Jeevan Anand Plan continues even after the policy term and the death benefit is paid even if the insured dies after the completion of the policy term. The scheme also takes care of liquidity needs through its loan facility. LIC New Jeevan Anand Plan is also a whole life plan with guaranteed returns and protection as it is not a market-based plan. LIC New Jeevan Anand is a Double Death Benefit Plan if the life insured survives until the end of the policy term. Here is everything you want to know.

| Plan No. | 915 |

| Launch Dated | 1 Feb 2020 |

Why we need such a Jeevan Anand policy?

You must be aware of the slogan “Jeendgi ke saath bhi aur Jeendgi ke baad bhi” what does it mean? Have you ever think of it? I am sure your answer is NO. Don’t worry; we just try to bring out some salient features.

No doubt, this is LIC’s New Jeevan Anand is an Endowment cum Whole Life Policy. The main attraction of this policy is:

- DAB — Double Accident Benefit

- Average Premium with High Return

- High Bonus — Being public sector LIC is known for its brand, reliability, and credibility. You may check its settlement ratio as per the IRDAI report.

- High Liquidity — This is the best of its kind plan that you can avail loan facility during and after policy term.

- Death Benefit after Policy Maturity is only Sum Assured.

- Death Benefit before Policy Maturity is Sum Assured+Bonus.

- Rebates in premiums are also available for high sum assured and premium paying mode.

- Tax exemption on the premium paid under Section 80C and the claim amounts under Section 10(10D) of the Income Tax Act, 1961.

In this plan, the Life Insured receives the Sum Assured + Bonus as Maturity Benefit but the life cover chosen continues till his death. Again an additional Sum Assured is paid whenever the Life Insured dies. Thus, this plan is both an endowment plan and a whole life plan.

However, if the life insured dies before the completion of premium paying term, i.e. within the policy tenure, the entire Sum Assured along with accrued bonus is paid to the nominee and the policy would terminate.

There is also an additional Accidental Death and Disability Benefit is payable till 70 years of age of the life insured.

What is the greatness of this Jeevan Anand plan?

- This plan is an endowment cum whole life plan

- Maturity Benefit is Sum Assured + accrued Bonus and the Life Cover continues till death

- Death Benefit after Policy Maturity is only Sum Assured

- Death Benefit before Policy Maturity is Sum Assured + accrued Bonus

- Simple Revisionary Bonus is payable on maturity or earlier death.

- Accidental Death and Disability Benefit is an inbuilt feature in this plan

- Optional higher cover through 1 additional rider of Critical Illness Benefit.

- This plan can be provided to people with hazardous occupations with an additional premium.

- Large Sum Assured rebate is also provided

What we would get if we go for Jeevan Anand plan?

- Tax Deduction Benefit — One can take benefit of Tax Deduction for the premium paid under u/s 80(C).

- Maturity Benefit — If one survives till the policy term then he/she deserves for maturity benefit. For example, the maturity amount is calculated as (Sum Assured + Accrued Bonus + Final Addition Bonus)

- Income Tax Benefit — Premiums paid under the life insurance policy are exempted from tax under Section 80 C and maturity proceeds are exempted from tax under section 10 (10D).

- Death Benefit — In case of death of the Life Insured

- Before the end of the Policy Term, the Sum Assured + accrued Bonus is paid

- After the Policy Term, Sum Assured is paid as Death Benefit whenever the Life Insured dies.

- Peace of Mind — If you have taken this policy then you can do whatever you wish throughout the policy term and after the term too. No fear, what will happen in your absence? How things will be managed in your absence?

What are the Benefits of this Jeevan Anand plan?

Death Benefit:

If the insured dies within the policy term, the Sum Assured and accumulated bonuses are paid to the nominee.

- 125% of the Basic Sum Assured as per policy terms, or

- 10 times of the annualized premium, or

- Minimum 105% of the total premiums payable as on the date of death, whichever is higher.

If the policyholder dies after the completion of the policy term while Maturity Benefit has already been paid, the Basic Sum Assured is then paid to the nominee and the plan terminates.

Maturity Benefit: In case the policyholder survives the entire policy tenure then, Basic Sum Assured + Accumulated Bonuses is paid to the insured as a maturity benefit after the completion of the policy term.

Rebate:

- 50%-3% if the Sum Assured is Rs. 2 lakhs and above.

- 2% for yearly mode.

- 1% for half-yearly mode.

- None for quarterly mode.

Loans: After 3 years policyholders can avail loan facilities. It depends upon the Surrender Value acquired by the policy.

Revival: Lapsed policy can be revived within 2 years from the date of 1st unpaid premium by paying the entire premium with interest and other expenses.

Surrender Value: Policyholder can surrender the policy at any time after 3 years and avail the Surrender Value which is calculated as:

- Guaranteed Surrender Value=30% of Total Premiums Paid–Premium of the 1st Year.

- The corporation can also fix a particular Surrender Value based on its future performance.

Premium Payment Flexibility: Policyholders can pay the premium monthly/quarterly/bi-annually/annually.

Additional Riders Benefit:

- Accidental Death Benefit Rider

- Disability Benefit Rider

Premium Discounts: In case of higher Sum Assured and yearly or half-yearly premium paying mode.

Income Tax Benefit:

Premiums: The premiums paid for the plan are exempt from taxation under Section 80C up to 1.5 lakhs.

Claim Amount: Maturity or Death Claim is also tax-free under Section 10(10D) with no limit.

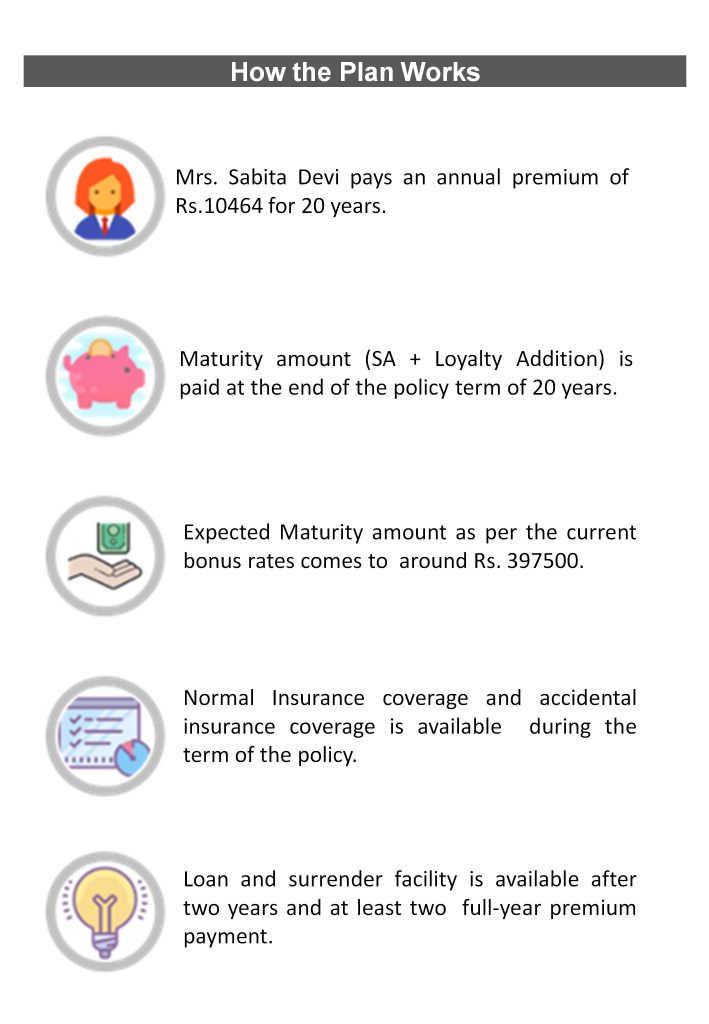

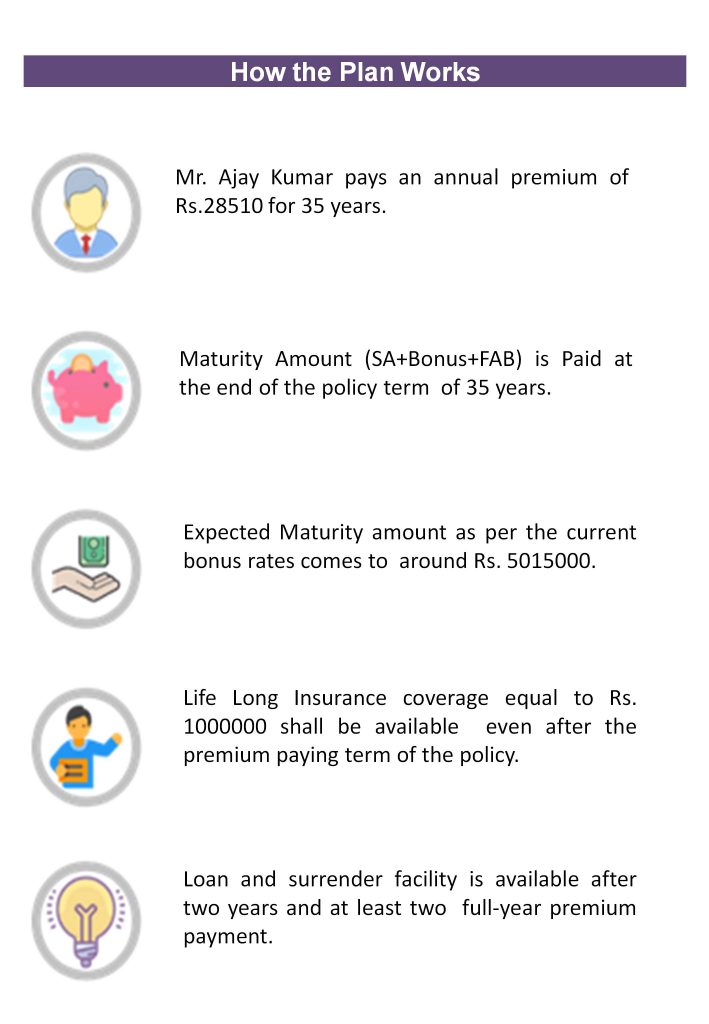

How this plan does works?

The policyholder selects a Sum Assured and Tenure as per the age that will determine the premium of the plan. In this plan, the policyholder has to pay premiums until the policy term.

- If the policyholder survives till the policy term then he/she is eligible for Maturity Benefit that is calculated as:

Maturity benefit=Sum Assured + Bonus + if any Final Addition Bonus is declared

- If the policyholder dies after the policy term, the nominee will get an additional Sum Assured amount as the Death Benefit.

- If the policyholder dies within the policy term then the Death Benefit is calculated as:

Death Benefit = Sum Assured + Vested Bonus + if any Final Additional Bonus is declared

The Sum Assured on Death will be higher — 125% of the Basic Sum Assured or 10 times the annual premiums paid subject to a minimum of 105% of total premiums paid till death.

What are the Eligibility conditions and restrictions in this Jeevan Anand plan?

| Minimum | Maximum | |

| Sum Assured (in Rs.) | 1,00,000 | No Limit |

| Policy Term (in years) | 15 | 35 |

| Premium Payment Term (in years) | 5 | 57 |

| Entry Age of Policyholder (last birthday) | 18 years | 50 years |

| Age at Maturity (last birthday) | - | 75 |

| Payment Modes | Yearly, Half-yearly, Quarterly, Monthly |

What are the Paid-up Value and Surrender Value in this plan?

Paid-up Value — If the policyholder has paid the 1st 3 years’ premiums and does not pay future premiums then the policy becomes a paid-up policy. Consequently, the Basic Sum Assured is reduced in proportion. Future bonuses are not added and on death or maturity, the reduced Sum Assured along with the vested bonuses is paid.

Surrender Value — If the policyholder wants to surrender the policy and avail the Surrender Value then the policy acquires a Surrender Value only if the 1st 3 years’ premiums have been paid.

Higher of the Guaranteed Surrender Value (GSV) or the Special Surrender Value (SSV) is paid. GSV and SSV are calculated as:

- GSV = (total premiums paid* GSV Factor) + (vested bonus * GSV factor of Bonus)

- SSV is declared by the company based on its performance.

Free-look Period — If the policyholder is not happy with the policy then he/she can cancel the policy within 15 days of the issuance. This period is called the free-look period. Upon cancellation, the premium paid after the deduction of expenses.

What are the Exclusions in this Jeevan Anand plan?

- If the policyholder commits suicide within 12 months of policy inception then only 80% of the premium paid is returned.

- If the policyholder commits suicide within 12 months of policy revival then higher of 80% of the premium paid or the Surrender Value is paid.

What is the document’s requirement to buy this New Jeevan Anand plan?

The plan is an offline plan which can be bought only through the agents or brokers. The following documents are required to buy this plan:

- Proposal/Application Form duly filled and signed with the required information

- Cheque or Cash for the 1st Premium Amount

- Identity Proof — PAN Card/Aadhaar Card/Passport/Voter ID Card/Driving License

- Address Proof — Aadhaar Card/Passport/Voter ID card/Driving License/Bank Account Statement/Electricity Bill/Telephone Bill/Passport

- Age Proof: Birth Certificate/ School Certificate/ Passport /Driving License etc

- Income Proof: Salary Slip/Certificate/IT Return

- Medical Reports, if needed

Additional Details

Simple Revisionary Bonuses

This is a participating plan. LIC declares bonus as per thousand Sum Assured annually. Once declared, it forms a part of the guaranteed benefits. Bonuses and Final (Additional) Bonus will be added during the term when the policy is in force or till death if it occurs earlier.

Grace Period

The policyholder gets a grace period of 30 days to pay the due premium. In case of non-payment, the policy can lapse.

Cancellation

The policyholder gets an option of free cancellation under which he can cancel his plan within 15 days of commencement.

Surrender Value

After 3 years, the policyholder can surrender the policy.

How to make a maturity or surrender claim?

The policyholder has to fill and sign the claim discharge form and submit it to the insurer.

In case of surrender, the policyholder has to intimate the LIC in writing to get the surrender value.

How to make a death claim?

The nominee has to fill up the claim discharge form and submit it to LIC with the following documents:

- Original Policy Bond

- NEFT Mandate Form

- Nominee’s Identity Proof

- Death Certificate

- Medical Report

- FIR, Newspaper cutting indicating the accident, copy of driving license in case of a road accident, postmortem report, etc.

Read to know more about this – LIC New Jeevan Anand: रोजाना 80 रुपये के निवेश पर पा सकते हैं 50 लाख, जानें क्या है ये पूरी पॉलिसी।

Also, read this – Why is LIC’s New Endowment Plan the Best Choice for Young People?

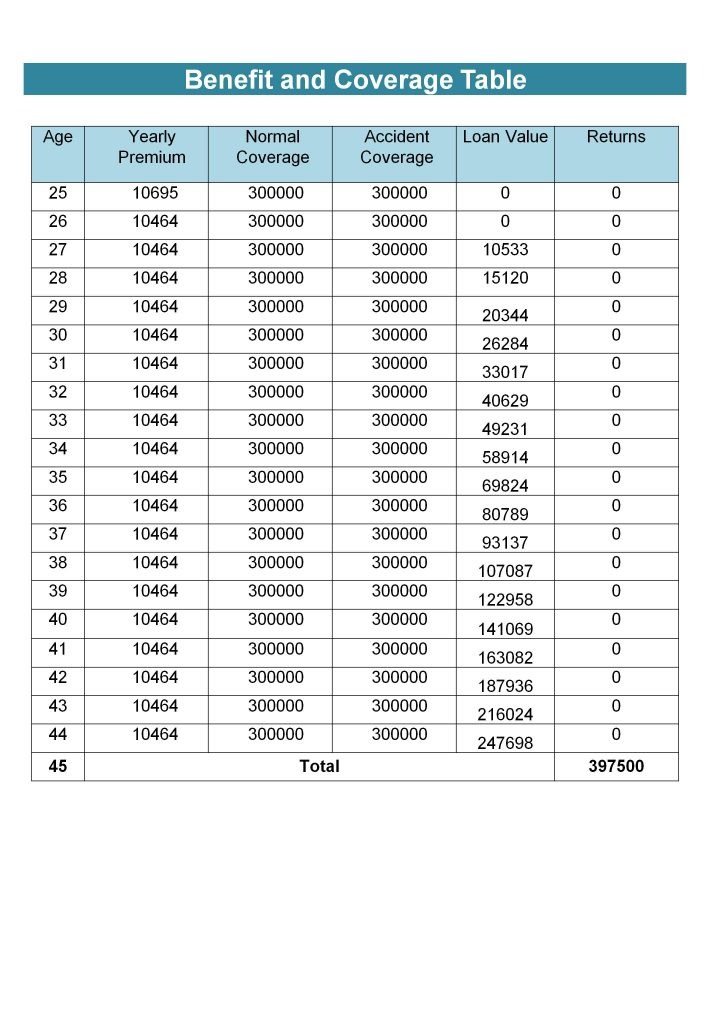

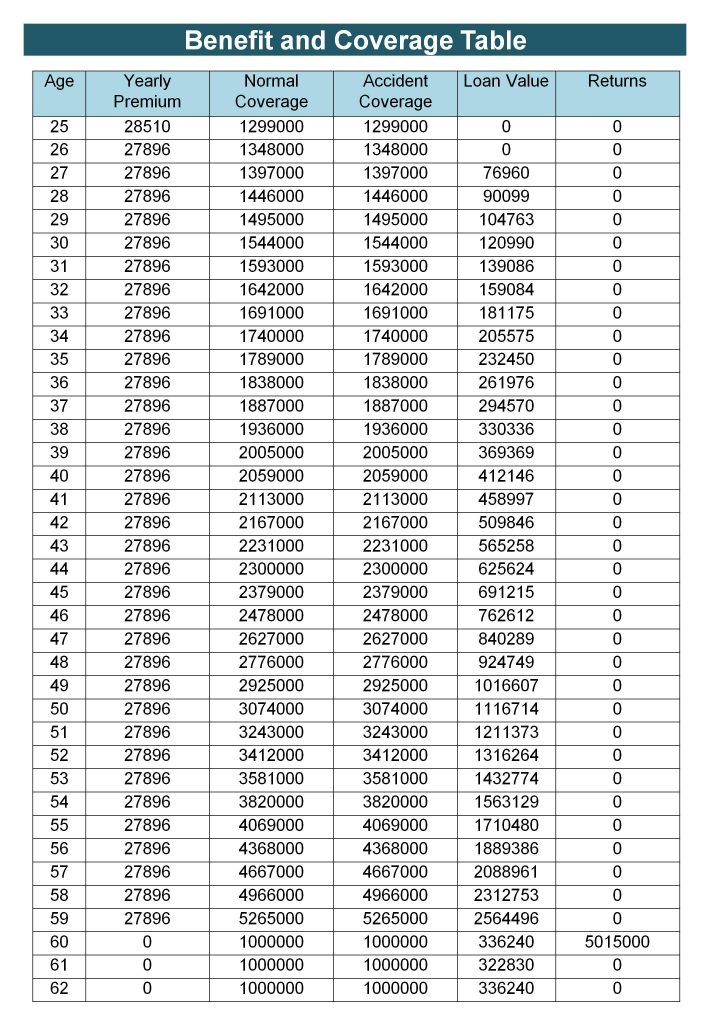

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.

FAQs on LIC’s Jeevan Anand Plan

FAQs on LIC’s Jeevan Anand Plan

Dummy

How much bonus is declared under the plan?

Is it possible to date back the policy?

What type of bonus is declared under the policy?

Does the plan provide a loan facility?

Are there any rebates on the premium?

The first on the high Sum Assured like 1.50% to 3%.

The second on premium paying Mode like 2% on Yearly or 1% on half-yearly mode.