Why should We Buy LIC’s Single-Premium Endowment Plan?

LIC’s Single Premium Endowment Plan

LIC Single Premium Endowment Plan No. 917 – is a participating, non linked endowment plan. In this plan, the premium is paid at the beginning, which is paid in a Lumpsum. It serves the investment purpose and even ensures it if one faces premature disappearance. There is a sure short return on this plan, this means that these plans are safe and provide financial benefits to you. The Single Premium Endowment Plan offers twin benefits of life protection and savings. Single Premium Endowment plans to provide coverage against risks and offer guaranteed returns. You can select the amount of coverage you want, depending on the details of the policy and the term that suits you best. Also, plans like the LIC Single Premium policy offer considerable premium discounts if you decide on a higher sum insured. This dual combination of protection and savings ensures that the family is always in a good financial position at all times. If the policyholder dies, it pays the Sum Insured plus the bonuses that can be declared every year (called the reversionary bonus) and at the end of the policy (called the terminal bonus). If the policyholder survives the term, this plan grants a Lumpsum payment based on the maturity benefit. These plans, therefore, allow you to create a secure corpus for your future. Single Premium Endowment plans are suitable for people who are looking for guaranteed returns on their investments and also want to have insurance coverage. These policies are basically for a long period of time since it helps to increase the overall returns that a person obtains at the end of the policy tenure. Even rebates exist on a Single Premium Endowment Plan if the highest sum is quoted. You can even avail of loans on this plan after 1 year. Here is everything you want to know.

| Plan No. | 917 |

| Launch Dated | 1 Feb 2020 |

Why we should buy this Single Premium Endowment Plan?

LIC’s Single Premium Endowment Plan is a Non- Linked, Participating, Individual, Life Assurance saving plan which offers an attractive combination of savings and protection features. The premium is paid in lump-sum at the outset of the policy. This combination provides financial protection against death during the policy term with the provision of payment of lumpsum at the end of the selected policy term in case of his/her survival. This plan also takes care of liquidity needs through its loan facility.

What are the Benefits available for this Single Premium Endowment Plan?

Death Benefit:

- On death during the policy term before the date of commencement of risk: Return of single premium (excluding taxes extra premium and rider premiums if any), without interest.

- On death during the policy term after the date of commencement of risk: Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus if any.

Where, “Sum Assured on Death” is defined as higher of Basic Sum Assured or 1.25 times of Single premium (excluding taxes, extra premium and rider premiums, if any).

Maturity Benefit:

On Life Assured surviving the policy term, Sum Assured on Maturity, along with vested Simple Reversionary Bonuses and Final Additional Bonus if any, shall be payable.

Participation in Profits:

The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation.

Final (Additional) Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity on such terms and conditions as may be declared by the Corporation from time to time.

What are the eligibility conditions and other restrictions?

- Minimum entry age: 90 days (completed)

- Maximum entry age: 65 years (nearest birthday)

- Maximum maturity age: 75 years (nearest birthday)

- Minimum policy term: 10 years

- Minimum age at maturity: 18 years (completed)

- Maximum policy term: 25 years

- Minimum Sum Assured: Rs.50,000

- Maximum Sum assured: No limit

Sum Assured will be in multiples of Rs.5,000 /- only.

- Premium payment mode: Single premium only

Date of Commencement of Risk: In case the age of Life Assured at entry is less than 8 years, f risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

What are the options available for this Single Premium Endowment Plan?:

Rider Benefits:

The following two optional riders are available under this plan by payment of additional premium.

LIC’s Accidental Death and Disability Benefit Rider

This rider is available at the inception of the policy only. If this rider is opted for, in case of accidental death, the Accident Benefit Rider Sum Assured will be payable as lumpsum along with the death benefit under the base plan. In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly installments spread over 10 years.

LIC’s New Term Assurance Rider

This rider is available at the inception of the policy only. The benefit cover under this rider shall be available during the policy term. If this rider is opted for, an additional amount equal to Term Assurance Rider Sum Assured shall be payable on the death of the Life Assured during the policy term.

The premium for LIC’s Accidental Death and Disability Benefit Rider shall not exceed 100% of premium under the base plan and the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the base plan

Each of the above Rider Sum Assured cannot exceed the Basic Sum Assured under the Basic plan.

For more details on the above riders, refer to the rider brochure or contact LIC’s nearest Branch Office.

What is the option to take Death Benefit in installments?

This is an option to receive a death benefit in installments over the chosen period of 5 or 10 or 15 years instead of a lump-sum amount. This option can be exercised by the Policyholder during the minority of the Life Assured or by Life Assured aged 18 years and above, during his/her lifetime; for full or part of Death benefits payable under the policy. The amount opted for by the Policyholder/Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum installment amount for different modes of payments being as under:

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Policyholder/Life Assured, the claim proceeds shall be paid in lump sum only.

The interest rates applicable for arriving at the installment payments under this option shall be as fixed by the Corporation from time to time.

For exercising an option to take Death Benefit in installments, the Policyholder during the minority of the Life Assured or the Life Assured, if major, can exercise this option during his/her life while in the currency of the policy, specifying the period of Instalment payment and net claim amount for which the option is to be exercised. The death claim amount shall then be paid to the nominee as per the option exercised by the Policyholder/Life Assured and no alteration, whatsoever, shall be allowed to be made by the nominee.

How can I understand through a sample illustrative premium?

The sample Illustrative Single premium (exclusive of taxes) for Basic Sum Assured of Rs 1 lakh for Standard lives are as under:

| Single-Premium per 1000 Sum Assured | |||

| Age (Nearest birthday) | Term | ||

| 10 | 15 | 25 | |

| 10 | 73,890 | 62,230 | 44,510 |

| 20 | 73,960 | 62,355 | 44,785 |

| 30 | 73,995 | 62,460 | 45,290 |

| 40 | 74,175 | 62,965 | 47,035 |

| 50 | 74,805 | 64,425 | 50,935 |

| 60 | 75,950 | 67,060 | – |

How much rebate can I avail for High Sum Assured?

High Sum Assured Rebates:

| Sum Assured (S.A) | Rebate (Rs.) |

| 50,000 to 95,000 | Nil |

| 1, 00,000 to 1, 95,000 | 18% of S.A. |

| 2, 00,000 to 2, 95,000 | 25% of S.A. |

| 3, 00,000 and above | 30% of S.A. |

How can I avail policy loans in this plan?

A loan can be availed under this plan any time after completion of the first policy year and subject to terms and conditions as the Corporation may specify from time to time.

The interest rate to be charged for policy loan and as applicable for the entire term of the loan shall be determined at periodic intervals. The applicable interest rate shall be as declared by the Corporation based on the method approved by the IRDAI.

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

How and when can I surrender my policy?

The policy can be surrendered at any time during the policy year. On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value or Special Surrender Value.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI

The Guaranteed Surrender Value allowable shall be as under:

- First-year: 75% of the Single premium

- Thereafter: 90% of the Single premium.

Single premium referred above shall not include taxes, extra premium & rider premium(s) if any.

In addition, the surrender value of vested simple reversionary bonuses, if any, shall also be payable, which is equal to vested bonuses multiplied by the Guaranteed Surrender Value factor applicable to vested bonuses. These factors will depend on the policy term and policy year in which the policy is surrendered.

The Corporation may, however, pay Special Surrender Value as applicable as on date of surrender provided the same is higher than Guaranteed Surrender Value.

What are the taxes implication?

Statutory Taxes, if any, imposed on such insurance plans by the Govt. of India or any other constitutional Tax Authority of India shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of applicable taxes, as per the prevailing rates, shall be payable by the policyholder on the single premium including extra premium & rider premium(s), if any, which shall be collected over and above in addition to the premiums payable by the policyholder. The amount of tax paid shall not be considered for the calculation of benefits payable under the plan.

Regarding Income tax benefits/implications on the premium paid and benefits payable under this plan, please consult your tax advisor for details.

How many days I would get for a free look period for this Single Premium Endowment Plan?

If the policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to the Corporation within 15 days from the date of receipt of the policy stating the reason for objections. On receipt of the same, the Corporation shall cancel the policy and return the amount of single premium deposited after deducting the proportionate risk.

premium (for the base plan & rider(s) if any) for the period of cover, an expense incurred on medical examination, special reports, if any, and stamp duty charge.

What are the exclusions for this Single Premium Endowment Plan?

Suicide:

The policy shall be void if the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk and under such case an amount which is higher of 90% of the Single Premium for Base Policy (excluding any taxes extra premium and rider premiums other than term assurance rider premium if any) or Surrender Value available as on the date of death shall be payable. The Corporation will not entertain any other claim under this policy.

Read to know more about this:

LIC के Single Premium Endowment Plan में रहता है ड्यूल बेनेफिट, पॉलिसी के 1 साल बाद लोन का भी विकल्प; जानें डिटेल्स।

Also, read this – Why is LIC’s New Endowment Plan the Best Choice for Young People?

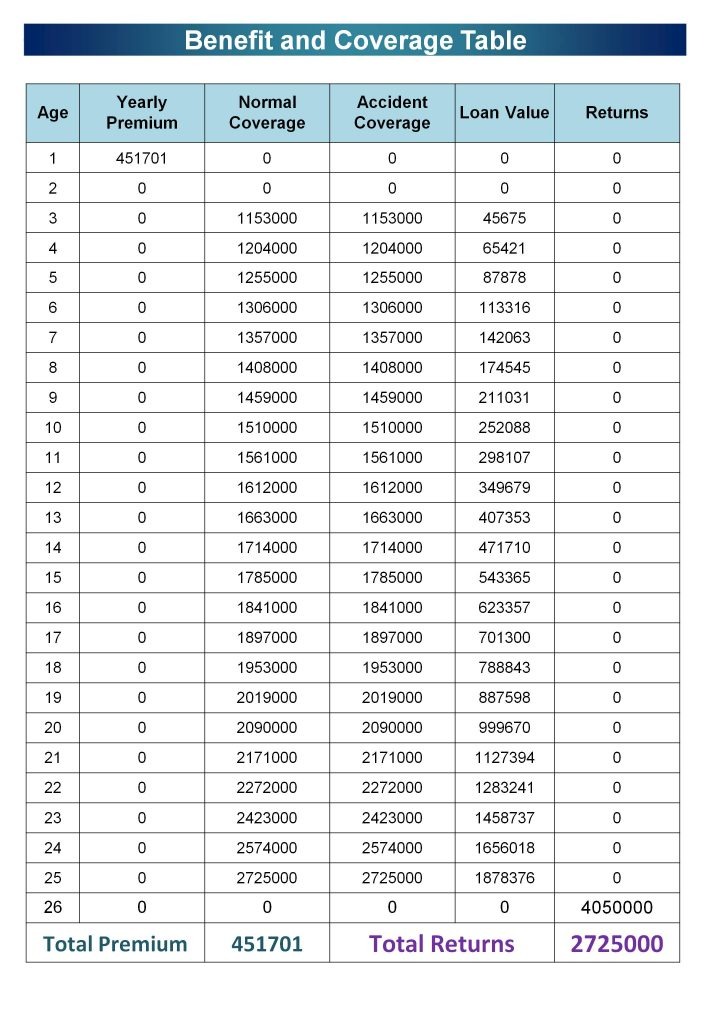

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.