LIC Jeevan Shanti Plan

Table of Contents

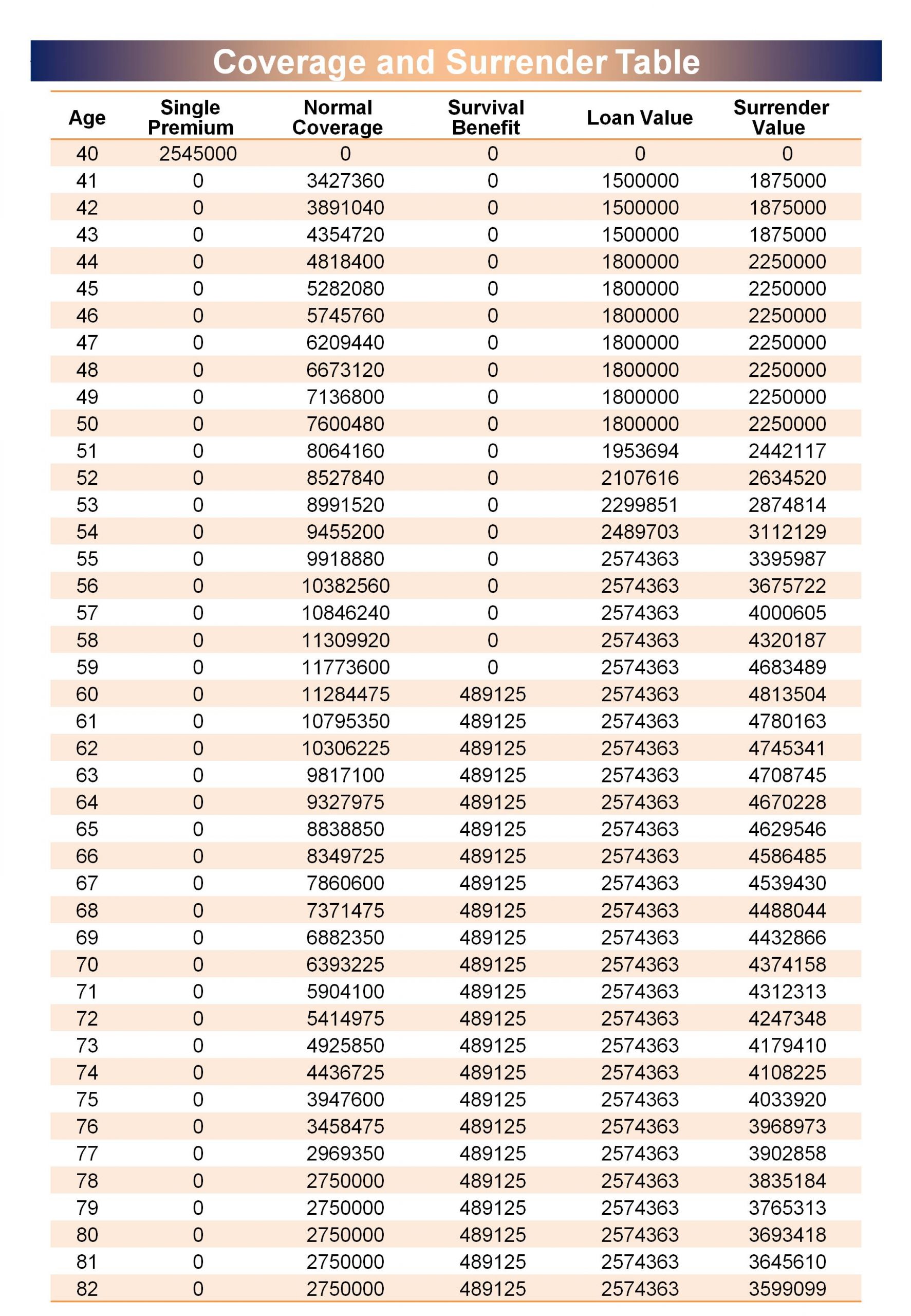

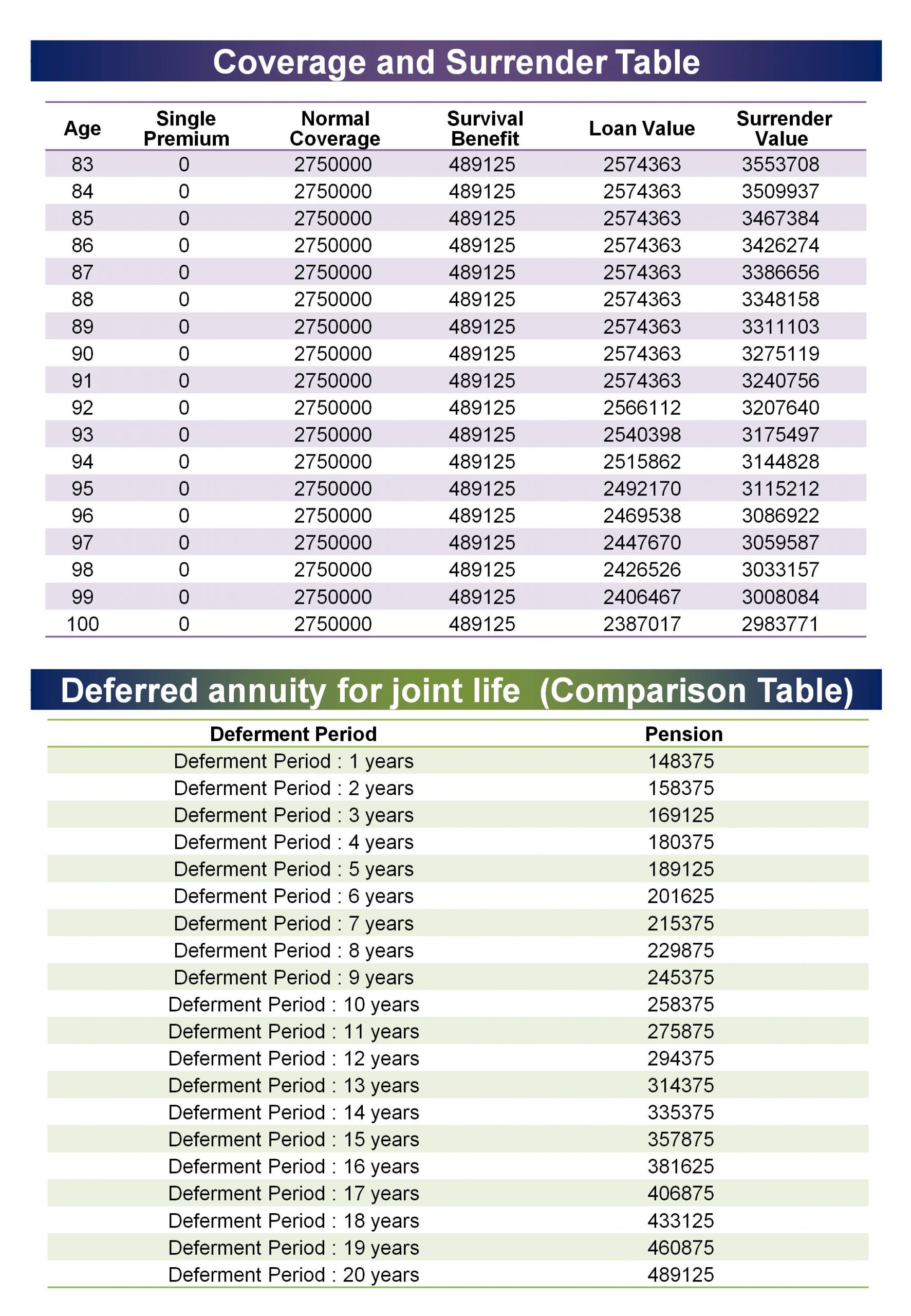

LIC Jeevan Shanti Plan is a single premium payment plan that provides a guaranteed annuity rate for immediate or deferred. The plan allows independence to opt-in with an “immediate annuity plan” or a “deferred annuity plan”. In an immediate annuity, you choose to withdraw the pension immediately. In a deferred annuity, you later choose to withdraw the pension you have fixed. This scheme is a type of retirement or pension scheme. The scheme is a non-linked and non-participation scheme. Both immediate and deferred plans provide many features and benefits. This plan is available both online and offline. The scheme pays a fixed sum upon retirement. You invest outright and get a lifetime income. Here is everything you want to know.

|

Plan No. |

850 |

|

Launch Dated |

24 Aug 2019 |

Why should we buy this LIC Jeevan Shanti Plan?

This is a single-premium plan in which the policyholder has the option of choosing an immediate or deferred annuity.

- The annuity rates are guaranteed at the inception of the policy for both Immediate and Deferred Annuity and annuities are payable throughout the lifetime of Annuitant(s).

- This plan is available offline as well as online.

What are the options available in this LIC Jeevan Shanti Plan?

The options available under Immediate Annuity are:

Option A: Immediate Annuity for life.

Option B: Immediate Annuity with a guaranteed period of 5 years and life thereafter.

Option C: Immediate Annuity with a guaranteed period of 10 years and life thereafter.

Option D: Immediate Annuity with a guaranteed period of 15 years and life thereafter.

Option E: Immediate Annuity with a guaranteed period of 20 years and life thereafter.

Option F: Immediate Annuity for life with return of Purchase Price.

Option G: Immediate Annuity for life increasing at a simple rate of 3% p.a.

Option H: Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on the death of the Primary Annuitant.

Option I: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and returns of Purchase Price on death of the last survivor.

The options available under Deferred Annuity are:

Option 1: Deferred annuity for Single life

Option 2: Deferred annuity for Joint life

What are the benefits available for this LIC Jeevan Shanti Plan?

Immediate Annuity:

Benefits payable under Immediate Annuity options are:

| Option | Benefits |

| Option A | . The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of Annuitant, nothing shall be payable and the annuity payment shall cease immediately. |

| Option B,C,D,E | . The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of the annuity payment. · On the death of the Annuitant during the guaranteed period, the annuity shall be payable to the nominee(s) till the end of the guaranteed period. . On the death of the Annuitant after the guaranteed period, nothing shall be payable and the annuity payment shallcease immediately. |

| Option F | . The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of the annuitant, the annuity payment shall cease immediately, and Purchase Price shall be payable to the nominee(s). |

| Option G | . The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of the annuitant, nothing shall be payable and the annuity payment shall cease immediately. |

| Option H | . The annuity payments shall be made in arrears for as long as the Primary Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of Primary Annuitant, 50% of the annuity amount shall be payable to the surviving Secondary Annuitant as long as the Secondary Annuitant is alive. The annuity payments will cease on the subsequent death of the Secondary Annuitant. . If the Secondary Annuitant predeceases the Primary Annuitant, the annuity payments shall continue to be paid and will cease upon the death of the Primary Annuitant. |

| Option I | . 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/ or Secondary Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of the last survivor, the annuity payments will cease immediately and nothing shall be payable. |

| Option J | . 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/ or Secondary Annuitant is alive, as per the chosen mode of the annuity payment. . On the death of the last survivor, the annuity payments will cease immediately and Purchase Price shall be payable to the Nominee(s). |

Deferred Annuity:

Benefits payable under Deferred Annuity options are:

| Option | Benefits |

| Option 1 | During the Deferment Period: On survival of the Annuitant, nothing shall be payable. On the death of the Annuitant, Death Benefit as defined below shall be payable to the nominee(s). After the Deferment Period: The annuity payments, as per the chosen mode, shall be made in arrears for as long as the Annuitant is alive. On the death of the Annuitant, the annuity payments shall cease immediately and Death Benefit as defined below shall be payable to the nominee(s). |

| Option 2 | During the Deferment Period: On the survival of the Primary Annuitant and/or Secondary Annuitant, nothing shall be payable. On the death of the last survivor, Death Benefit as defined below shall be payable to the nominee(s). After the Deferment Period: The annuity payments, as per the chosen mode, shall be made in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive. On the death of the last survivor, the annuity payments shall cease immediately and Death Benefit as defined below shall be payable to the nominee(s). |

Death Benefit:

Death Benefit (applicable only in case of Deferred Annuity) shall be:

Higher of

- Purchase Price plus Accrued Guaranteed Additions (as specified below) minus Total annuity amount paid till the date of death, if any

Or,

- 110% of Purchase Price

Accrued Guaranteed Additions (applicable only in case of Deferred Annuity): Guaranteed Additions shall accrue at the end of each policy month, till the end of the Deferment Period only. The rate of Guaranteed Additions during the deferment Period shall be as under:

Guaranteed Additions per month = (Purchase Price * Annuity rate p.a. payable monthly) / 12 Where Annuity rate p.a. payable monthly shall be equal to monthly tabular annuity rate and shall depend on the age at entry of the annuitant(s) and the deferment period opted for. In the event of the beneficiary’s death during the deferral period, the Guaranteed Additions for the policy year in which the death occurred will accrue up to the policy month completed on the date of death.

What are the eligibility criteria?

Minimum Purchase Price: Rs.1,50,000 subject to minimum Annuity as specified below Maximum Purchase Price: No Limit

What is the mode of annuity payment?

The annuity modes available under immediate and deferred annuity are annual, semi-annual, quarterly, and monthly. The annuity will be paid in default, that is, the annuity payment will be after 1 year, 6 months, 3 months and 1 month from the policy start date for immediate annuity options or the grant date of the deferred annuity options depending on whether the mode of payment of the annuity is annual, semi-annual, quarterly and monthly, respectively.

Minimum Age at Entry: 30 years (completed) Minimum Annuity:

| Annuity Mode | Monthly | Quarterly | Half-yearly | Annual |

| Minimum Annuity | Rs.1000 per month | Rs.3000 per quarter | Rs.6000 per half-year | Rs.12000 per annum |

Joint Life: The joint-life annuity can be taken between any lineal descendant/ascendant of a family (i.e. Grandparent, parents, Children, Grandchildren) or spouse or siblings.

| Criteria | Immediate Annuity | Deferred Annuity |

| Maximum Age at Entry | 85 years (completed) except Option F | 79 years (completed) |

| 100 years (completed) for Option F | ||

| Minimum Deferment Period | Not Applicable | 1 year |

| Maximum Deferment Period | 20 years subject to Maximum Vesting Age | |

| Minimum Vesting Age | 31 years (completed) | |

| Maximum Vesting Age | 80 years (completed) |

Is there any incentive for a higher purchase price?

The following incentives are available under both Immediate and Deferred Annuity:

An incentive for higher purchase price by way of increase in the annuity rate is as under:

| For per 1000/- Purchase price (in Rs.) | |||||

| Mode of Annuity | 5,00,000 to 9,99,999 | 10,00,000 to 24,99,999 | 25,00,000 to 49,99,999 | 50,00,000 to 99,99,999 | 1,00,00,000 & above |

| Yearly | 1.50 | 2.10 | 2.45 | 2.60 | 2.70 |

| Half Yearly | 1.40 | 2.00 | 2.35 | 2.50 | 2.60 |

| Quarterly | 1.35 | 1.95 | 2.30 | 2.45 | 2.55 |

| Monthly | 1.30 | 1.90 | 2.25 | 2.40 | 2.50 |

What is the adjustment factor applicable under Deferred Annuity for frequencies other than yearly mode?

The reduction by way of a decrease in annuity rate shall be applicable under Deferred Annuity for frequencies other than the yearly mode. The reduction is as under:

| Mode | Reduction in (Yearly) annuity rate |

| Half-yearly | 2% |

| Quarterly | 3% |

| Monthly | 4% |

How can I understand it with the help of an illustration?

Purchase Price: Rs. 10 lakh (excluding applicable taxes)

Age of Annuitant at entry: 45 years (LBD)

Annuity Mode: Yearly

Deferment Period: 20 years (applicable for Deferred Annuity only)

Age of Secondary Annuitant at entry: 35 years (LBD) (applicable for Joint life annuity only)

| Annuity Option | Annuity Amount (Rs.) |

| Immediate Annuity: | |

| Option A: Immediate Annuity for life | 66,200 |

| Option B: Immediate Annuity with a guaranteed period of 5 years and life thereafter | 66,100 |

| Option C: Immediate Annuity with a guaranteed period of 10 years and life thereafter | 65,900 |

| Option D: Immediate Annuity with a guaranteed period of 15 years and life thereafter | 65,500 |

| Option E: Immediate Annuity with a guaranteed period of 20 years and life thereafter | 65,000 |

| Option F: Immediate Annuity for life with return of Purchase Price | 56,000 |

| Option G: Immediate Annuity for life increasing at a simple rate of 3% p.a | 49,100 |

| Option H: Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on the death of the Primary Annuitant | 62,900 |

| Option I: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives | 59,900 |

| Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of the last survivor | 55,500 |

| Deferred Annuity: | |

| Option 1: Deferred annuity for Single life | 1,76,000 |

| Option 2: Deferred annuity for Joint life | 1,93,500 |

What are the options available for this LIC Jeevan Shanti Plan?

Death Benefit

Under all the annuity options where there is a benefit payable on death i.e. Option F and Option J under Immediate Annuity and both the Options under Deferred Annuity, the Annuitant(s) will have to choose one of the following options for the payment of the death benefit to the nominee(s). The death claim amount shall then be paid to the nominee as per the option exercised by the Annuitant(s) and no alteration whatsoever shall be allowed to be made by the nominee(s).

Lumpsum Death Benefit:

The full purchase price / death benefit will be paid to the nominees in lumpsum.

Annuitisation of Death Benefit:

The amount of the death benefit payable will be used to purchase an Immediate Annuity from the Corporation for the nominee (s).

In Installment:

The amount of the death benefit payable can be received in installments during the chosen period of 5 or 10 or 15 years instead of a lump sum. Installments will be paid in advance at annual or semi-annual or quarterly or monthly intervals, as chosen, subject to the amount of the minimum installment for the different forms of payment as:

| Mode of Installment payment | Minimum installment amount |

| Monthly | Rs. 5000/- |

| Quarterly | Rs. 15000/- |

| Half-Yearly | Rs. 25000/- |

| Yearly | Rs. 50000/- |

If the Net Amount of the claim is less than the amount required to provide the minimum amount of the installment according to the option exercised by the Annuitant(s), the proceeds of the claim will be paid in a lump sum.

What is the surrender value in this LIC Jeevan Shanti Plan?

The policy can be surrendered at any time after three months from the end of the policy (that is, 3 months from the date of issuance of the policy) or after the expiration of the review period, whichever occurs later only under the following annuity options:

Immediate annuity

- Option F: Immediate Annuity for life with return of Purchase

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last

Deferred annuity

- Option 1: Deferred annuity for Single life

- Option 2: Deferred annuity for Joint life

If the annuity option chosen is different from the one specified above, the policy surrender will not be allowed. Upon payment of the surrender value, the policy will terminate and all other benefits will cease.

Guaranteed Surrender Value Factors shall be:

| Policy Year | 1 | 2 | 3 | 4 | 5 and above |

| GSV Factor | 75% | 75% | 75% | 90% | 90% |

How can I avail the loan facility under this LIC Jeevan Shanti Plan?

The loan facility shall be available after completion of 1 policy year. Policy loan shall be allowed under the following annuity options only:

The loan facility will be available after completing 1 year of the policy. Policy loan will be allowed only under the following annuity options:

Immediate annuity

- Option F: Immediate Annuity for life with return of Purchase

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last

Deferred annuity

- Option 1: Deferred annuity for Single life

- Option 2: Deferred annuity for Joint life

The maximum loan amount that may be granted under the policy will be such that the effective amount of annual interest payable on the loan does not exceed 50% of the annual annuity amount and will be subject to a maximum of 80% of the Surrender Value.

What is the tax benefit available in this LIC Jeevan Shanti Plan?

The amount of any applicable taxes shall be payable by the policyholder on Purchase Price. The main condition of availing exemption under Section 80CCC is that the policy for which the money has been spent must be providing a pension or a periodic annuity.

What is the free look period provided in this LIC Jeevan Shanti Plan?

If the policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy can be returned to the Corporation within 15 days (30 days if this policy is purchased online) from the date of receipt of the policy bond stating the reasons for objections. Upon receipt, the Corporation will cancel the policy and return the Purchase Price paid after deducting the stamp duty charges and the annuity paid, if applicable.

What are the exclusions in this LIC Jeevan Shanti Plan?

Suicide:

For Immediate Annuity (applicable only for Option F and J)

The policy will be void if the Annuitant / Primary Annuitant / Secondary Annuitant (either sane or insane at the time) commits suicide at any time within 12 months from the start date of the risk, an amount that is greater than 100 % of the Purchase price paid or the Surrender Value will be payable. The Corporation will not consider any other claim.

For Deferred Annuity:

The policy will be void if the Annuitant / Primary Annuitant / Secondary Annuitant (either sane or insane at the time) commits suicide at any time within 12 months from the start date of the risk, an amount that is greater than 80 % of the Purchase Price paid or the Surrender Value will be payable. The Corporation will not consider any other claim.

What is the prohibition of rebates Section 41 of the Insurance Act, 1938?

No person shall permit or offer to permit, either directly or indirectly, as an incentive for a person to contract or renew or continue insurance, except rebate which is permitted in accordance with the brochures or tables published by the insurer. Any person who does not comply with the provisions of this section will be liable for a fine that can be extended to ten lakh rupees.

Read to know more about this:

- LIC: एक बार प्रीमियम दें और पाएं जीवन भर पेंशन!

- LIC की ये स्कीम देगी 15 फीसदी तक ब्याज, जानिए क्या है शर्त!

- LIC की इस खास पॉलिसी में लगाएं पैसा, 65 हजार रुपये की मिलेगी पेंशन!

- LIC की इस पॉलिसी में एक प्रीमियम भरकर पाएं हर महीने 4 लाख रुपये पेंशन!

- LIC की इस पॉलिसी में एकमुश्त निवेश कर पा सकते हैं हर महीने 10 हजार रु पेंशन!

- LIC का नया प्लान: जमा करें बस 5 लाख, आजीवन होगी 96 हजार रु सालाना इनकम!

Also, read this — Why is LIC’s New Endowment Plan the Best Choice for Young People?

Plan Illustration

Disclaimer:

The Premium amount shown here is indicative and informational. The actual premium amount can vary according to underwriting rules. Maturity calculations shown here are also based on the current bonus rates. It can also vary based on the actual performance of the corporation. For more details on risk factors, terms, and conditions, please read the policy documents carefully before concluding a sale.

FAQs

FAQs

Who is an Annuitant?

What is Vesting Date?

What is Purchase Price?

Can I invest multiple times in my existing policy?

What are the tax benefits of the LIC Jeevan Shanti Plan?

What is the difference between immediate and deferred annuity?

LIC's Market Share 75.9%, Growth in NB Premium 39.46%, Growth in 1st Year Premium 25.17%, Growth in Total Premium 12.42%, Growth in Gross Total Income 9.83%, Growth in Total Asset Value 2.71%, Growth in Digital Transaction 36% in FY 2019-20.

It also has a Claim Settlement ratio of 98.33%.

It is the most trusted Life Insurance Company in the country. It has a Sovereign Guarantee which other Companies don't have.

![]() WHY GO SOMEWHERE ELSE?

WHY GO SOMEWHERE ELSE?

0 Comments